What is a tax deduction carryover balance? How to find out when the tax deduction for an apartment will be transferred. Property deduction for pensioners

Date of publication: 02/22/2017 16:26 (archive)

The Internet service developed by the Federal Tax Service to help taxpayers is gaining increasing popularity.

800 thousand St. Petersburg residents already use the capabilities of the “Taxpayer’s Personal Account”, receive up-to-date information about their taxes, and pay taxes online.

Using the service you can:

Receive information about property and vehicles, the amounts of accrued and paid taxes, the presence of overpayments and debts;

- control the status of settlements with the budget;

- receive and print tax notices and tax receipts, pay taxes;

- receive reconciliation reports;

- contact the tax authorities without a personal visit.

The Office of the Federal Tax Service of Russia for St. Petersburg publishes answers to frequently asked questions about the work of the “Taxpayer’s Personal Account”.

1. Question: Is it possible to submit an application for a refund of personal income tax through the Internet service of the Federal Tax Service of Russia “Taxpayer Personal Account for Individuals”?

Answer: Yes, from July 1, 2015, it has been possible for individual taxpayers to send refund (offset) applications to the tax authority, signed with an enhanced non-qualified electronic signature through the tab: “Income Tax FL/3-NDFL/Generate an application for refund, sign with an enhanced unqualified electronic signature and send.”

2. Question: How to select a tax authority in the Internet service of the Federal Tax Service of Russia “Taxpayer Personal Account for Individuals” to send a tax return in Form 3-NDFL?

Answer: When generating the 3-NDFL declaration online through the Internet service “Personal Account”, the taxpayer fills in the registration address at the place of residence (registration). Based on the entered address, the inspection code to which the declaration will be sent is automatically determined.

In accordance with Article 11 of the Tax Code of the Russian Federation, the place of residence of an individual is the address at which the individual is registered in the manner established by the legislation of the Russian Federation.

3. Question: Are documents signed with a non-qualified electronic signature and sent through the “Taxpayer’s Personal Account” legally significant? If I have attached documents in electronic form, signed with an electronic signature, to the 3-NDFL declaration, do I need to bring a paper version to the tax authority?

Answer: Documents signed with an electronic signature - qualified or unqualified - are legally significant and equivalent to documents presented on paper.

If you sent supporting documents scanned and signed with an enhanced qualified or enhanced unqualified signature as attachments to the 3-NDFL declaration, then you do not need to duplicate them on paper. Please note that in some cases, when conducting a desk inspection, the inspector has the right to request the original document - in this case, the inspector will contact you.

4. Question: How can I obtain a non-qualified electronic signature key certificate?

Answer: Obtaining an electronic signature verification key certificate is available to the user using the link “Obtaining an electronic signature verification key certificate” in the “Profile” section.

Your Personal Account offers two options for installing an electronic signature key certificate. In the first case, the key certificate will be stored on your computer, in the second - in the protected storage of the Federal Tax Service of Russia. If you install a certificate on your computer, you will need a desktop computer or laptop (not available for tablets or phones), a Windows operating system and administrator rights. If stored in the storage facility of the Federal Tax Service of Russia, it is possible to use any devices and operating systems. In both cases, the electronic signature verification key certificate will be a full-fledged tool for electronic document management through the “Personal Account”. More detailed information is provided in the corresponding section when installing the key.

5. Question: I need to fill out a tax deduction declaration in form 3-NDFL. To do this, you need a certificate in form 2-NDFL. There is no possibility to request this certificate from a tax agent in the near future. Can I obtain this information from the tax authority?

Answer: The provisions of the Tax Code of the Russian Federation do not provide for the obligation of tax authorities to provide certificates in Form 2-NDFL on income received, calculated and withheld and transferred amounts of personal income tax.

At the same time, on the taxpayer’s page of the Internet service of the Federal Tax Service of Russia “Taxpayer’s personal account for individuals” in accordance with the procedure for maintaining a taxpayer’s personal account, approved by Order of the Federal Tax Service of Russia dated June 30, 2015 No. ММВ-7-17/260@ “On approval of the procedure for maintaining personal account" in the "Income Tax" tab, in the "Information on certificates on form 2-NDFL" section reflects information on income received from tax agents for the three previous tax periods.

Information on income for 2016 will be available in the “Personal Account” Internet service after 06/01/2017.

6. Question: Last year, part of the right to a property tax deduction was exercised by submitting a tax return in form 3-NDFL. To further exercise the right to this deduction, I fill out a tax return, but I do not remember the balance of the deduction that was transferred from the previous tax period. There is no such information in my “Personal Account”. Where can I find this data necessary to fill out the declaration?

Answer: The Tax Code of the Russian Federation does not provide for informing taxpayers about the balance of the property tax deduction when purchasing housing that carries over to the next tax period.

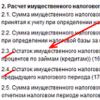

In the Internet service of the Federal Tax Service of Russia “Taxpayer’s Personal Account for Individuals” in the tab “Income Tax/3-NDFL/Progress of verification of the declaration for .... years" in the column "Amount of property tax deduction for expenses on construction or acquisition of an object" reflects the amount of the provided property tax deduction in previous tax periods. The amount of the balance of the property tax deduction transferred from the previous tax period is equal to the difference between the total amount of the deduction to which the taxpayer has the right, in accordance with subparagraph 3 of paragraph 1 of Article 220 of the Tax Code of the Russian Federation and the amounts of property tax deductions provided in previous tax periods.

In addition, you have the right to fill out a tax return in accordance with the information available. If errors and (or) contradictions are identified in a tax return, the tax authority official conducting the tax audit has the right to request the necessary explanations from the person being inspected or to notify that appropriate corrections have been made within the prescribed period (clause 3, Article 88 of the Tax Code of the Russian Federation).

7. Question: I sent a declaration to the tax authority. If its desk audit is completed before three months, how can I find out about this and will I be notified about the completion of the tax audit?

Answer: There is no provision for informing taxpayers about the completion of a desk tax audit under the Tax Code of the Russian Federation.

Information about the submitted tax return in Form 3-NDFL, the amount of tax to be refunded from the budget (to be paid to the budget) and information about the completion of the desk tax audit are reflected in the Internet service of the Federal Tax Service of Russia “Taxpayer’s Personal Account for Individuals” in the “Tax on Tax” tab. income/Z-NDFL” in the column “Date of completion of desk audit”.

8. Question: I submitted a refund for the purchase of an apartment in the 2015 declaration, where can I find out what amount to return in the 2016 declaration?

Answer: In accordance with subparagraph 3 of paragraph 1 of Article 220 of the Tax Code of the Russian Federation, the taxpayer has the right to receive a property tax deduction in an amount not exceeding 2,000,000 rubles. Consequently, the total amount of refund of personal income tax (hereinafter referred to as personal income tax) at a rate of 13% from 2,000,000 rubles will be no more than 260,000 rubles. At the same time, the taxpayer is refunded the personal income tax withheld by the tax agent for the year.

If a property tax deduction cannot be used in full during a tax period, its balance is carried over to the next tax period until it is fully used.

Thus, when exercising part of the right to deduction and partial refund of personal income tax (according to the declaration for 2015), it is possible to obtain a refund of the remaining amounts, in particular, by submitting a declaration for 2016. In this case, the amount of personal income tax subject to refund from the budget is calculated as 13% of the amount of the balance of the tax deduction transferred from the previous tax period, but not more than the amount of personal income tax withheld by the tax agent in 2016. If the personal income tax to which the taxpayer is entitled is greater than the amount of personal income tax withheld by the tax agent, then the amount of tax withheld by the tax agent is returned and the resulting balance is again transferred to the subsequent tax period.

In the “Taxpayer’s Personal Account for Individuals” in the “Income Tax/3-NDFL/Progress of verification of the declaration for... years" in the column "Amount of property tax deduction for expenses on construction or acquisition of an object" reflects the amount of the provided property tax deduction in previous tax periods. The amount of the balance of the property tax deduction transferred from the previous tax period is equal to the difference between the total amount of the deduction to which the taxpayer has the right in accordance with subparagraph 3 of paragraph 1 of Article 220 of the Tax Code of the Russian Federation and the amounts of property tax deductions provided in previous tax periods.

After the digital signature key has been generated and an access password has been created, you can use all the services of your Personal Account. During initial registration, information about the deduction balance can be found using the “Feedback” menu. By following the link, you can write a question to a representative of the Federal Tax Service in free form (“Please provide information on the amount of the balance of the property deduction to receive a personal income tax refund when purchasing an apartment. Please send the deduction amount to the email address”). If the initial declaration was sent by you through your Personal Account, then you can check the balance of the deduction in the electronic form of the document in the “Personal Income Tax and Insurance Contributions – Declaration 3-NDFL” tab (page “I”, line 210). Remaining deduction for a mortgage The Tax Code provides for the right of citizens to receive a deduction when applying for a mortgage loan.

How to find out the remaining tax deduction for an apartment

2,000,000 is the maximum amount of expenses for new construction or purchase of housing on the territory of the Russian Federation, from which a tax deduction will be calculated. In case of acquisition of property after January 1, 2014, the deduction limit applies to expenses incurred for the acquisition of one or several real estate properties. 3,000,000 rubles is the maximum amount of expenses for the construction and purchase of housing (land for it) when repaying interest on targeted loans (credits). The limit on the amount of interest paid on targeted loans (credits) accepted for deduction applies to loans (credits) received after January 1, 2014.

The amounts of interest paid on targeted loans (credits) received before 2014 can be included in the property deduction in full without any restrictions.

Remaining property tax deduction

HomeNewsAutoWorkHomeLeisureBusinessDatingHealthMailForumsWeatherReal EstateAdvertisementsTourismPosterSPEDaCatalogHelpCommunication Services: , | News: | Publications: , | Consultations: | Forums: , Update | List of Forums | Search | Rules | Statistics | Blocking list | Online: 1 Topics Author Replies Views Last reply Useful links (FAQ) (1 | 2 | 3 | 4 | 5) Moderator 119 188157 Apr 23, 2018 12:39 Valuation of your property and advice on buying/selling it (1 | 2 | 3 | 4 | 5 | .... | 277 | 279 | 280) Moderator 6978 648169 20 Apr 17:54 84 | 85 | 86 | 87) ORK 2162 263499 Apr 18, 2018 14:04 Technological connection to EESC networks (1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10) _EESK 230 20517 Apr 13, 2018 17 :33 decline in real estate prices (1 | 2 | 3 | 4 | 5 | ….

How to find out your tax deduction balance

In addition to the main amount of compensation (in general, up to 260 thousand rubles), you can return personal income tax calculated from the amount of accrued interest. However, as in the situation with deductions for housing purchased with one’s own savings, processing a mortgage return has its own nuances. They are as follows:

- if you took out a mortgage before 01/01/14, then you can return the tax on the entire amount of accrued interest (the tax deduction is equal to 100% of the interest amount);

- If the loan was received after 01/01/14, then the amount of interest deduction for you is limited to 3 million.

rub., that is, you can compensate a maximum of 390 thousand rubles.

Please note that when determining the amount of the deduction, the decisive factor is the date of registration of ownership and the fact of receipt of the apartment according to the transfer and acceptance certificate.

Other expenses, in addition to those listed, are not taken into account as part of the property deduction, for example, expenses associated with the redevelopment and reconstruction of premises, the purchase of plumbing and other equipment, registration of transactions, etc. The home purchase deduction does not apply in the following cases:

- if payment for the construction (purchase) of housing was made at the expense of employers or other persons, funds from maternal (family) capital, as well as from budget funds;

- if the purchase and sale transaction is concluded with a citizen who is interdependent in relation to the taxpayer.

Interdependent persons are recognized as: an individual, his spouse, parents (including adoptive parents), children (including adopted children), full and half brothers and sisters, guardian (trustee) and ward (Article 105.1 of the Tax Code of the Russian Federation).

Property deduction when purchasing property

Procedure for obtaining You must contact the tax office and submit an application to receive a deduction. It can be issued on paper or electronically in advance. The applicant must indicate his income, as well as provide information confirming the fact of purchasing real estate or obtaining a mortgage loan.

Required documents To receive the remainder of the property tax deduction, you must provide:

- certificate 2-NDFL;

- declaration 3-NDFL;

- certificate of payment of interest, as well as payment documents;

- title documents for real estate;

- deed of transfer of real estate.

Here you can find a sample 2-NDFL certificate, a sample application for a tax deduction, and a sample 3-NDFL declaration. A citizen can contact the Federal Tax Service in person or through a representative.

How to find out the balance of the property tax deduction

- evidencing the payment of interest under a target credit agreement or loan agreement, mortgage agreement (in the absence or “burnout” of information in cash receipts, such documents can serve as extracts from the taxpayer’s personal accounts, certificates from the organization that issued the loan about the interest paid for using the loan).

5 When purchasing property for common joint ownership, we prepare:

- a copy of the marriage certificate;

- a written statement (agreement) on the agreement of the parties to the transaction on the distribution of the amount of the property tax deduction between the spouses.

6* We provide the tax authority at the place of residence with a completed tax return with copies of documents confirming actual expenses and the right to receive a deduction when purchasing property.

How to calculate the remaining property tax deduction

Attention

At the end of 2008, the taxpayer retired and had no income taxed at the rate of 13 percent. In accordance with subparagraph 2 of paragraph 1 of Article 220 of the Code of the Russian Federation (hereinafter referred to as the Code), when determining the size of the tax base, the taxpayer has the right to receive a property tax deduction in the amount of expenses actually incurred by the taxpayer, but not more than 2,000,000 rubles. Obtaining the balance of the property deduction in subsequent years In practice, it often happens that it is not possible to obtain a deduction for the purchase or construction of housing for actual expenses incurred during one period due to the limitation of the amount of income received by the taxpayer, therefore, according to the Tax Code of the Russian Federation, the balance of the deduction is transferred to subsequent years.

Let me remind you that in order to receive a property deduction for the tax inspectorate, you need to prepare documents according to the list specified in paragraph 2 of Article 220 of the Tax Code of the Russian Federation.

How to get the rest of the property tax deduction

If, according to an extract from Rosreestr, you received ownership of the apartment before 01/01/14, then the amount of deduction for you is unlimited. Read also the article: → “Tax deduction when purchasing an apartment in a new building in 2018” The balance of the deduction for mortgage loans is determined in accordance with the general procedure. The amount of deduction received from previous transactions is subtracted from the total limit (2 million rubles).

When calculating, all deductions received are summed up, including those received when purchasing a home with your own funds. The indicator of the remaining deduction from the cost of housing purchased on credit can be viewed in line 2.10 of sheet “I”. As for the balance of the deduction for accrued interest, they are displayed in the declaration only if a home was purchased after 01/01/14.

You can monitor the progress of the declaration verification and the decision on payment in the taxpayer’s Personal Account on the tax.ru website, in the “Taxpayer Documents - Electronic Document Management” section. Methods for gaining access to a taxpayer’s Personal Account are described on the Federal Tax Service website. According to the law, the tax service has three months to verify the submitted declaration and documents. Based on the results of the audit, a decision is made to provide a tax deduction. After receiving the decision, you need to contact the Federal Tax Service with an application to transfer funds to the account, specify the bank and account number. Transfers will be received within a month from the date of filing the application with the Federal Tax Service. In order to conveniently control the process of checking your declaration, you need to register in your personal account on the official website of the tax service.

How to find out the remaining tax deduction for an apartment

In addition to the main amount of compensation (in general, up to 260 thousand rubles), you can return personal income tax calculated from the amount of accrued interest. However, as in the situation with deductions for housing purchased with one’s own savings, processing a mortgage return has its own nuances.

They are as follows:

- if you took out a mortgage before 01/01/14, then you can return the tax on the entire amount of accrued interest (the tax deduction is equal to 100% of the interest amount);

- if the loan was received after 01/01/14, then the amount of interest deduction for you is limited to 3 million rubles, that is, you can compensate a maximum of 390 thousand rubles.

Please note that when determining the amount of the deduction, the decisive factor is the date of registration of ownership and the fact of receipt of the apartment according to the transfer and acceptance certificate.

Find out the tax deduction status

- home

- Tax deduction

In this article we will learn how to find out the remaining tax deduction. Let's look at the step-by-step algorithm. We will answer common questions.

Important

Persons who bought real estate can get back part of the money spent by applying for a tax deduction. The provisions of the Tax Code of the Russian Federation provide citizens with the right to use the remainder of the property deduction when making the next transaction.

Today we will talk about how to find out the remaining tax deduction. Refund of personal income tax when buying a home Buying real estate is an important and desirable step in the life of every family.

Attention

But this event is always associated with significant financial expenses. In order to support families who decide to improve their living conditions and acquire their own housing, the state gives citizens the right to return part of the funds spent.

Tracking the progress of tax return verification in your personal account

Believe it or not, this is a wonderful gift from the state the moment you bought an apartment. There are deductions not only for the purchase of an apartment, but in this article I will only talk about them. After all, the costs of buying an apartment (building a house), renovations, etc., probably took almost all your free money. How to get the rest of the property tax deduction When purchasing residential real estate, individuals can receive a property tax deduction in the amount of expenses incurred, but not more than 2 million rubles (subclause 2, clause 1, article 220 of the Tax Code of the Russian Federation). If during the first period (year) the deduction is not fully used, then its balance can be transferred to subsequent years. In this case, repeated submission of documents confirming the right to such is not required.

How to find out when the tax deduction for an apartment will be transferred?

This instruction has been compiled for those who have decided to save their personal time and apply for their social (treatment, education) or property deduction (for the purchase of an apartment, room or house) via the Internet. For these purposes, the tax office has created a personal account in which you can You can submit your declaration online, confirming the data specified in it with scanned copies of the necessary documents. Where and how to do this correctly? Read about this and much more below.

1 step First of all, you need to go to the website of your personal account of the tax service: https://lkfl.nalog.ru/lk/ By clicking on the link, you will be taken to the authorization page. How to log into your personal tax account? You have 2 options:

- You must contact any Federal Tax Service.

You must have your passport and your TIN with you (a copy or original is possible).

Find out about the status of the 3rd personal income tax return verification and tax refund.

The maximum period for paying a tax deduction for an apartment and other purchased property is 3 calendar months, after this period the money should arrive in your account from the tax service. You can control this process by registering in your personal account on the website of the Russian tax service. Our tax office says that three months are allotted for checking the 3-NDFL declaration and the documents attached to it, and the fourth month is transferred.

Although in practice some people found it faster. And of course, you can independently check your account online, to which the deductions should be transferred. Please note that you can return the tax for the purchase of an apartment either through the employer or through the tax service. If you choose the second method, everything will take about 3 months.

How to find out your tax deduction balance

After “identity confirmation” you will be able to log into your personal account using your account. Step 2 Having entered your personal account, the first thing you need to do to be able to file a tax deduction through your personal account is to obtain an electronic signature verification key certificate. With this key you will sign a set of documents that you will attach in step 10. To do this, in the upper right corner, click: profile. Step 3 Next, click: obtain an electronic signature verification key certificate. Step 4 On the key creation page, you choose one of two methods; you will see their differences in the picture:

- The electronic signature key is stored on your workstation

- The electronic signature key is stored in the secure system of the Federal Tax Service of Russia.

Step 5 I recommend using: The electronic signature key is stored in the secure system of the Federal Tax Service of Russia.

Citizens who have submitted an income declaration to the tax office in Form 3-NDFL in order to receive a social or property tax deduction can use the Internet service of the Federal Tax Service of Russia “Taxpayer Personal Account for Individuals” to clarify the status of the tax document verification. We remind you that the maximum period for checking a tax return is 3 months from the date of its submission to the tax authority. After completing the check, a message about the results will appear in the “3-NDFL” section of the electronic resource: “A decision has been made to provide a tax deduction” indicating the confirmed amount of the deduction or “A decision has been made to refuse to provide a tax deduction.” The funds are returned to the taxpayer to the personal account specified in the application, which can be submitted along with the tax return.

Where can I see the remaining tax deduction on the tax website?

The Federal Tax Service has developed an Internet service “Taxpayer Personal Account for Individuals” to facilitate informing its taxpayers. Now it is possible to instantly and easily find out about all transactions related to your taxes, close tax debts via the Internet without leaving home, communicate with the tax office and track the status of a desk audit of your tax return using Form No. 3-NDFL.

Users who have completed a 3NDFL declaration to receive any tax deductions can find out the status of their application for a tax refund and the results of a desk tax audit. The section contains information about the registration number, the declaration you submitted, the start and end date of the desk audit, the stage of the desk audit “Started” or “Completed” and the registration date with the Federal Tax Service.

When the tax return is verified, within a month the amount of overpaid tax is transferred to the taxpayer’s account specified in the application. The taxpayer can check the status of the desk audit online on the tax service website in his personal account by going to the Income Tax FL / 3-NDFL tab. On the same page, just below, you can see information on the refund of the tax amount to the taxpayer’s account.

After the digital signature key has been generated and an access password has been created, you can use all the services of your Personal Account. During initial registration, information about the deduction balance can be found using the “Feedback” menu.

By following the link, you can write a question to a representative of the Federal Tax Service in free form (“Please provide information on the amount of the balance of the property deduction to receive a personal income tax refund when purchasing an apartment. Please send the deduction amount to the email address”). If the initial declaration was sent by you through your Personal Account, then you can check the balance of the deduction in the electronic form of the document in the “Personal Income Tax and Insurance Contributions – Declaration 3-NDFL” tab (page “I”, line 210).

Remaining deduction for a mortgage The Tax Code provides for the right of citizens to receive a deduction when applying for a mortgage loan.

If, according to an extract from Rosreestr, you received ownership of the apartment before 01/01/14, then the amount of deduction for you is unlimited. Read also the article: → “Tax deduction when purchasing an apartment in a new building in 2018” The balance of the deduction for mortgage loans is determined in accordance with the general procedure.

The amount of deduction received from previous transactions is subtracted from the total limit (2 million rubles). When calculating, all deductions received are summed up, including those received when purchasing a home with your own funds.

The indicator of the remaining deduction from the cost of housing purchased on credit can be viewed in line 2.10 of sheet “I”. As for the balance of the deduction for accrued interest, they are displayed in the declaration only if a home was purchased after 01/01/14.

Legal basis - Federal Law No. 224-FZ dated November 26, 2008 “On amendments to part one, part two of the Tax Code of the Russian Federation and certain legislative acts of the Russian Federation.”

2003, then the amount of the deduction will be 600 thousand rubles. if before January 1, 2008 – 1 million rubles. And if the costs of purchasing housing were incurred in 2008 or later, then 2 million rubles.

First things first.

To receive the remainder of the property tax deduction, you no longer need to resubmit documents to the inspectorate

Letter of the Federal Tax Service of Russia dated August 12, 2013 No. AS-4-11/ regulates the procedure for submitting supporting documents in order to obtain the balance of property tax under personal income tax.

In accordance with paragraph 2 of paragraph 1 of Article 220 of the Tax Code of the Russian Federation, when determining the size of the tax base for personal income tax, the taxpayer has the right to receive a property tax deduction in the amount of expenses actually incurred, in particular, for the purchase of an apartment on the territory of the Russian Federation , rooms or share(s) in them, but not more than 2,000,000 rubles.

Property deduction for pensioners

Individuals have the right to transfer the balance of the unused property deduction for the purchase of residential real estate to subsequent years until its full use (paragraph 28, paragraph 2, clause 1, article 220 of the Tax Code as amended by the Tax Code, in force until 01/01/2014)

For pensioners who do not have taxable income at a rate of thirteen percent, a special procedure has been established for transferring the deduction. The Federal Tax Service, in a letter dated June 15, 2012 N ED-3-3/2098, explains that this procedure can be applied starting from a year in which there is no taxable income.

According to para.

Property tax deduction for pensioners

This article discusses how to obtain a property tax deduction for retirees. In order for non-working pensioners to fully realize their right, it is necessary to strictly adhere to the deadlines for providing the necessary documents. Otherwise, you may lose significant amounts. From January 1, 2012 in Art. 220 of the Tax Code, changes have been made according to which pensioners can receive a property deduction when purchasing a property (apartment, room, land plot or share thereof).

Explanations on how to apply the property tax deduction for pensioners can be found in Letter of the Ministry of Finance dated February 3, 2012 No. 03-04-05/7-112.

Since pensioners do not have income taxed at a rate of 13%, the legislator determined that when purchasing a property, a pensioner has the right to transfer the balance of the property deduction to previous tax periods, but not more than three.

For example: A pensioner retired in February 2012, and in October 2012 purchased a house with land.

How to get a tax deduction?

What is tax? (If absolutely correct, then property). Believe it or not, this is a wonderful gift from the state the moment you bought an apartment. There are deductions not only for the purchase of an apartment, but in this article I will only talk about them.

After all, the costs of buying an apartment (building a house), renovations, etc., probably took almost all your free money.

How to get the rest of the property deduction

When purchasing residential real estate, individuals can receive a property tax deduction in the amount of expenses incurred, but not more than 2 million rubles (subclause 2, clause 1, article 220 of the Tax Code of the Russian Federation). If during the first period (year) the deduction is not fully used, then its balance can be transferred to subsequent years. In this case, repeated submission of documents confirming the right to such is not required.

According to Article 93 of the Tax Code of the Russian Federation, authorities are prohibited from demanding from the person being inspected documents previously submitted during desk or field tax audits.

How to find out your tax deduction balance

A property deduction is a kind of tax benefit that appears to citizens of the Russian Federation when dealing with property. For example, you bought or sold land, a house or an apartment, and also if you took out a mortgage, then you are entitled to a property deduction. Property reduces the amount of a citizen’s tax base, thereby reducing the amount of tax paid to the budget.

a deduction is the amount by which the tax base is reduced.

What is the procedure for transferring property deductions for purchased housing for pensioners?

For pensioners, the code provides for a special procedure for transferring the balance of the property deduction for purchased housing. The balance is carried forward not to subsequent years, but to previous years. However, only non-working pensioners can take advantage of the preferential procedure.

The Tax Code allows taxpayers to carry over the balance of the unused property deduction for purchases to subsequent years until it is completely exhausted (paragraph 28, subparagraph 2, paragraph 1, Article 220 of the Tax Code).

Tax benefits when buying a home

You purchased real estate: an apartment, a room, a residential building, part of a residential building or a share that has a separate cadastral number. Perhaps you had to use a mortgage loan... When purchasing a home, a citizen has the right to use the property provided for in Article 220 of the Tax Code of the Russian Federation.

From January 1, 2010, tax rules also apply to situations related to the purchase of a residential building (or its share) with a land plot or a land plot intended for individual construction.

Personal income tax: transfer of property deduction

That in 2008 the taxpayer purchased an apartment and in 2009, based on income for 2008, the taxpayer received a property tax deduction. At the end of 2008, the taxpayer retired and had no income taxed at the rate of 13 percent.

In accordance with subparagraph 2 of paragraph 1 of Article 220 of the Code of the Russian Federation (hereinafter referred to as the Code), when determining the size of the tax base, the taxpayer has the right to receive a property tax deduction in the amount of expenses actually incurred by the taxpayer, but not more than 2,000,000 rubles.

Receiving the balance of the property deduction in subsequent years

In practice, it often happens that it is not possible to obtain a deduction for the purchase or construction of housing for actual expenses incurred during one period due to the limitation of the amount of income received by the taxpayer, therefore, according to the Tax Code of the Russian Federation, the balance of the deduction is transferred to subsequent years.

Let me remind you that in order to receive a property deduction for the tax inspectorate, you need to prepare documents according to the list specified in paragraph 2 of Article 220 of the Tax Code of the Russian Federation.

The procedure for transferring the balance of property deduction for expenses on purchasing an apartment to previous tax periods

From January 1, 2012, taxpayers receiving pensions, if they do not have income subject to personal income tax at a rate of 13 percent, are given the opportunity to transfer the balance of property to previous periods, but not more than three.

It is reported, in particular, that the three-year period for the refund of overpaid tax is counted starting from the tax period immediately preceding the tax period in which the carryover property balance was formed.

At the same time, it is indicated that if the taxpayer does not apply for the transfer of the balance of property immediately, but in subsequent tax periods (for example, after a year), then the number of tax periods to which the above balance can be transferred is correspondingly reduced.

From the appeal it follows that in 2008 the taxpayer purchased an apartment and in 2009 the taxpayer received property tax on income for 2008.

Find out the tax deduction status

Having received documents for a tax deduction from a citizen, the Federal Tax Service must carry out all the necessary work with them (checking, assessing and making a decision on payment) within three months. There are several ways to find out your tax deduction status.

The first, most accessible way is to call the Federal Tax Service office. In practice, most territorial tax authorities allow the provision of data on the consideration of applications for deductions by telephone.

Today, many individuals have a deduction for previous years that has not yet been paid to them. How to calculate the amount of residual material compensation due to the taxpayer as a personal income tax refund for one or another type of expense will be clearly described in this article.

- The maximum discount limit is 2,000,000 rubles. In cases where the value of the property is more than two million, the applicant for the deduction by law can only count on compensation equal to 13% of the maximum allowable limit - 260,000 rubles.

- The deduction limit is 3,000,000 rubles. Many individuals, due to high real estate prices, take out a mortgage or some other type of loan. In this situation, the maximum amount by which you can reduce the size of your tax base is three million rubles, and the amount of compensation is 13% of it, which is 390,000 rubles.

- Innovations for 2017. As you know, a tax discount, which is related to the acquisition of property, can be obtained even many years after the date of its purchase. In 2017, it is allowed not only to return money for long-standing property expenses, but also to independently choose the date for receiving them. For example, having returned part of the money in 2019, the taxpayer may receive the rest not in subsequent years, but even several years later.

Example of determining the remainder

Consider the following situation: a certain Andrey Petrovich Novikov became the owner of an apartment, the cost of which is 3,500,000 rubles. For the last ten years, he has paid the same amount for personal income tax - 8,500 rubles. The amount of the deduction in this case is 260,000 rubles, since the price of the apartment is significantly more than two million rubles.

Thus, after registering a reduction in the tax base for the purchase of a property, Andrei Petrovich will first be accrued 8,500 rubles. Then next year, as well as in each subsequent year, he will receive the same amount until he is paid 260,000 rubles.

The deduction that will remain after accruing 8,500 rubles for the first year will be equal to 251,500, for the second year - 243,000 (251,500 - 8,500), for the third - 234,000 and so on.

How to calculate deductions for previous years

The algorithm for calculating deductions for previous years is quite simple. In this regard, absolutely every taxpayer can cope with calculating the amount of the remaining tax credit. To carry out this procedure, you must perform the following steps:

- Determine the exact amount of the deduction that has already been issued. To begin with, an individual should sum up all the monetary compensation that he has already received to date. For example, if for the last three years the taxpayer has been transferred 5,000 rubles, then the total amount of compensation received will be equal to 15,000 rubles.

- Subtract the amount already issued from the original deduction amount. From the total amount of monetary compensation recorded in the tax return as a deduction, it is necessary to subtract the amount that has already been transferred to the taxpayer’s bank card. Thus, if the total tax discount is 45,500 rubles, and at the moment the individual has already been given 15,000 rubles, then the balance is 35,500 rubles.

How to find out deductions for previous years

Sometimes it happens that for some reason some taxpayers make mistakes when calculating the tax rebate they are entitled to for previous years. To eliminate the possibility that the results obtained are incorrect, you can not do the calculations at all, but simply come to the tax office and ask for information regarding the exact amount of the balance.

However, you need to apply for information of this kind not to any tax service, but to the one that is located at the place of registration of the person who wants to know the amount of the deduction for previous years.