List of statistical reporting. Statistics: reports. Forms for large enterprises

Good afternoon, dear individual entrepreneurs!

In addition to reports on taxes and contributions, individual entrepreneurs must periodically submit reports to Rosstat. Unfortunately, there is no single and constant list of what and when an individual entrepreneur must submit to Rosstat. The fact is that this list completely depends on what exactly the individual entrepreneur does and is constantly changing, as new reporting is regularly introduced. Fortunately, most individual entrepreneurs do not submit statistical reports very often.

Yes, once every 5 years individual entrepreneurs submit reports on continuous observation. Rosstat sent out notifications to everyone by mail with a ready-made form to fill out. You can also find out what statistical reports need to be submitted when using online accounting services or in 1C.

By the way, I constantly encourage the use of accounting programs for tax (accounting) accounting, since the developers of such programs regularly update them and upload the necessary reports.

But now an official service has appeared, with which you can quickly check yourself. The service is as simple as the truth.

Where can I find this service?

Update. The service has changed and is now located at a new address:

There was a problem with the https protocol in the video, but it has now been fixed.

I remind you that you can subscribe to my video channel on Youtube using this link:

P.S. Below we describe how to use the old version of the service. But since it has been updated, I advise you to watch the video above.

- In the drop-down list, select “Notice for individual entrepreneurs...”

- Enter your OGRNIP and click on the “Search” button

Then click on the “List of Forms” button

And download the PDF file, which will indicate that you need to take the IP.

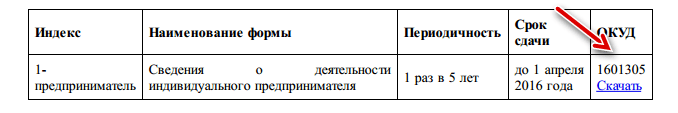

For example, I got this result:

This is the same continuous observation questionnaire that all individual entrepreneurs took at the end of 2015. The form itself can be downloaded from the link in the document.

P.S. Check yourself regularly to avoid possible problems. It’s even better to use accounting programs (the same “1C: Entrepreneur”), where all these statistical reports are generated automatically. By pressing a few buttons. Requests from Rosstat for reporting cannot be ignored, as a significant fine will follow.

P.P.S. Screenshots are from the website http://statreg.gks.ru/

Don't forget to subscribe to new articles for individual entrepreneurs!

And you will be the first to know about new laws and important changes:

Dear entrepreneurs!

A new e-book on taxes and insurance contributions for individual entrepreneurs on the simplified tax system of 6% without employees is ready for 2019:

"What taxes and insurance premiums does an individual entrepreneur pay under the simplified tax system of 6% without employees in 2019?"

The book covers:

- Questions about how, how much and when to pay taxes and insurance premiums in 2019?

- Examples for calculating taxes and insurance premiums “for yourself”

- A calendar of payments for taxes and insurance premiums is provided

- Frequent mistakes and answers to many other questions!

Dear readers!

A detailed step-by-step guide to opening an individual entrepreneur in 2019 is ready. This e-book is intended primarily for beginners who want to open an individual entrepreneur and work for themselves.

This is what it's called:

"How to open an individual entrepreneur in 2019? Step-by-step instructions for beginners"

From this manual you will learn:

- How to properly prepare documents for opening an individual entrepreneur?

- Selecting OKVED codes for individual entrepreneurs

- Choosing a tax system for individual entrepreneurs (brief overview)

- I will answer many related questions

- Which supervisory authorities need to be notified after opening an individual entrepreneur?

- All examples are for 2019

- And much more!

Who must submit statistical reports in 2017

In addition to mandatory tax and accounting reporting, companies and individual entrepreneurs must report to Rosstat. Small and micro enterprises have an advantage over large companies and can be completely exempt from the obligation to submit statistical reports. We will tell you in this article how to find out about the composition of the reports that your company needs to submit based on the results of 2016, and when to send them to the statistical authorities.

What to submit to Rosstat?

Companies that are not small and medium-sized businesses submit a certain set of statistical reports. There are mandatory forms, and there are those that depend on the area of activity.

In 2017, Rosstat Order No. 414 dated August 11, 2016, which approves the main forms of statistical observation, remains relevant and in force. This document contains forms for both small and micro enterprises, as well as for legal entities that do not fall into these categories. There are also Rosstat orders approving specific forms. For example, the annual form 1-Enterprise was approved by Rosstat Order No. 691 dated December 9, 2014, and Rosstat Order No. 498 dated October 26, 2015 approves five forms at once.

Basic forms that non-small businesses must submit:

What does Rosstat expect from small businesses?

As mentioned above, such businessmen most often submit reports to Rosstat using a simplified scheme, and some do not report at all.

The obligation to submit statistical reports for small and medium-sized businesses is enshrined in Art. 5 of the Federal Law of July 24, 2007 No. 209-FZ. The same law defines the criteria for classifying companies and individual entrepreneurs as small and medium-sized businesses. The basic requirements are:

1. The share of participation of other Russian legal entities in the authorized capital of the LLC cannot be higher than 25%, and the share of foreign companies - 49%.

2. The number of employees should not exceed the limits established by law: for micro-enterprises no more than 15 people, for small enterprises - the maximum allowable value of 100 people, for medium-sized enterprises - no more than 250 people.

3. Annual income should not exceed the limits: micro-enterprises - 120 million rubles; small enterprises - 800 million rubles; medium-sized enterprises - 2 billion rubles (Resolution of the Government of the Russian Federation dated April 4, 2016 No. 265).

Rosstat conducts two types of monitoring of the activities of companies and individual entrepreneurs: continuous and selective.

Continuous surveillance for small and medium-sized businesses is carried out every five years. The last time it was held was in 2015. In 2016, small companies and individual entrepreneurs submitted the MP-SP and 1-Entrepreneur forms, respectively, based on the results of the previous year. If the legislation does not change, the next continuous observation will await small and medium-sized businesses based on the results of 2020. Usually Rosstat issues additional orders with the required forms and recommendations for filling them out; some companies receive the corresponding forms by mail.

Sample observation is carried out continuously, and reporting may change from year to year. You can find out whether your company is included in the sample on the Rosstat website or by calling the territorial statistics office. In addition, Rosstat must notify companies about being included in the sample in writing or orally. Territorial statistical authorities may request additional forms.

The most common forms submitted by small and micro enterprises and individual entrepreneurs are 1-IP, MP (micro) - in kind, PM, TZV-MP, etc.

Advice! If you do not know what reports to submit to the statistical authorities, check with your territorial office by phone. This will help your company avoid fines.

Mandatory reporting to Rosstat

Regardless of the number and type of activity, all companies that are required to prepare accounting (financial) statements must submit a copy of it to the territorial statistics body before March 31 (for 2016 until 03/31/2017). This obligation is enshrined in Art. 18 Federal Law dated December 6, 2011 No. 402-FZ.

If you do not submit your financial statements on time, the company may be fined 3-5 thousand rubles, and its director - 300-500 rubles (Article 19.7 of the Code of Administrative Offenses of the Russian Federation).

Responsibility for violation of deadlines

Statistical reporting can be submitted on paper or electronically (the method of submission is usually indicated on the form).

Violation of deadlines for statistical reporting or failure to submit it is punishable by serious fines (Article 13.19 of the Administrative Code):

- the company will pay from 20 to 70 thousand rubles;

- the manager will pay from 10 to 20 thousand rubles.

Repeated violations can cost the manager 30-50 thousand rubles, and the company 100-150 thousand rubles.

During 2017, companies and individual entrepreneurs are required to submit reports to statistical authorities, and they are set individually for each organization. But the penalty for not providing information is equally severe for everyone. In this manual, you will learn when and what reports to submit to statistics in 2017, how to find out by OKPO and TIN, what Rosstat expects from you.

Who and how to report to Rosstat in 2017

The main criterion by which statistical reporting is divided in 2017 is which economic entity you belong to. This determines when and what kind of reports the company submits to statistics in 2017.

First, we will determine where your company belongs, and then, using a convenient table, we will check which reports to submit to Rosstat.

Check if your company is small or medium

There are three criteria that a company must simultaneously comply with in order to be a small and medium-sized enterprise.

Share of participation

The first criterion is the total share of participation of constituent entities of the Russian Federation, municipalities, public and religious organizations, various funds in the authorized capital of the company. It should not exceed 25%, and the share of participation of organizations that are not small and medium-sized enterprises, as well as foreign companies in the management company should not exceed 49% for each share.

Number of employees

- for medium-sized companies - from 101 to 250 people,

- for small ones - from 16 to 100 people,

- for micro-enterprises - no more than 15 people.

Income

The last criterion is business income for 2016 in total for all types of activities and tax regimes. Income limits are set by the Government of the Russian Federation. From August 1, 2016, the limits are approved by Decree of the Government of the Russian Federation dated April 4, 2016 No. 265. We have listed them in the table below.

Note! A company's status changes if revenue and headcount deviate from the limits for three consecutive years. This is stated in paragraph 4 of Article 4 of the Federal Law of July 24, 2007 No. 209-FZ. Violation of limits for one year does not deprive the company of the status of small or medium

What concessions are there for “kids”

For individual entrepreneurs, small and medium-sized enterprises, there is a system of continuous and sample statistical observations. Continuous observations are carried out once every five years (the last time was carried out in 2016), and then all representatives of small businesses and individual entrepreneurs were required to report to Rosstat.

In 2017, there will be only selective reporting to statistics, in which only those included in the sample list submit reports. We will tell you below how to find out whether your company is subject to a random check or not.

It is worth clarifying that all of the above applies only to small enterprises and private businesses; all other organizations are required to submit all required reports to Rosstat in 2017.

What reports to submit to statistics in 2017

On January 1, 2017, Rosstat introduced new reporting forms; we have made all the changes in the following table.

What reports should be submitted to statistics monthly?

Types of reports |

When to take it |

Who rents |

|---|---|---|

|

PM-prom “Information on the production of products by a small enterprise” |

Small enterprises (except micro) and individual entrepreneurs employing from 16 to 100 people, producing products from mining and processing industries, production and distribution of electricity, gas and steam, logging, and fishing |

|

|

1-IP (months) “Information on the production of products by an individual entrepreneur |

4th day of the month following the reporting month |

Individual entrepreneurs, employing 101 or more people, producing products from mining and manufacturing industries, producing and distributing electricity, gas and steam, engaged in logging and fishing. |

|

No. 1 - producer prices Information on producer prices of industrial goods (services)" |

22nd day of the month following the reporting month |

Legal entities (except micro), individual entrepreneurs (with more than 101 employees) producing goods and services of the following types of activities: forestry industry; fisheries; mining; manufacturing industries; provision of electricity, gas and steam; air conditioning; water supply; waste collection and disposal; publishing activities. Poultry farms also submit the form. |

|

9-KS “Information on prices for purchased basic building materials, parts and structures” |

25th of the reporting month |

Legal entities (except micro) performing work in the “Construction” type of activity |

|

P-3 “Information on the financial condition of the organization” |

28th day of the month following the reporting month |

Legal entity (except for small businesses) |

|

2-purchase prices “Information on purchase prices of certain types of goods” |

18th day of the month following the reporting month |

Legal entities (except micro) related to the types of economic activities of sections A, B, C, D, E and groups 47.11, 47.22, 47.23, 47.25 and 47.26 of the OKVED2 classifier |

|

2-purchase prices (grain) “Information on average prices for grain purchased by industrial organizations for main production” |

15th day of the month following the reporting month |

Legal entities engaged in the production of grain products |

|

1-TARIFF “Information on tariffs for the transportation or pumping of a ton of cargo by various modes of transport, including via pipeline” |

23rd day of the reporting month. |

Legal entities involved in the transportation of goods, including through pipelines (oil, gas, etc.) |

What statistical reports does an accountant submit every quarter in 2017?

Types of reports |

When to take it |

Who rents |

|---|---|---|

|

PM “Information on the main performance indicators of a small enterprise” |

Last day of the month following the reporting quarter |

Legal entities – small enterprises, except micro-enterprises |

|

DAP-PM “Survey of business activity of small enterprises in mining, manufacturing, provision of electricity, gas and steam, air conditioning” |

10th day of the last month of the reporting quarter |

LE-MP (except micro), operating in the field of mining, manufacturing, supply of electricity, gas and steam, air conditioning |

|

1-РЗ “Information on the price level in the housing market” |

2nd day of the month following the reporting quarter |

Legal entities, individual entrepreneurs engaged in real estate transactions |

|

P-6 “Information on financial investments and liabilities” |

20th day of the month following the reporting quarter |

Medium and large enterprises |

What reports should we submit once a year?

Types of reports |

When to take it |

Who rents |

|---|---|---|

|

MP (micro) “Information on the main performance indicators of a micro-enterprise” |

Microenterprises only |

|

|

1-IP “Information on the activities of an individual entrepreneur” |

The period depends on the type of business |

Individual entrepreneur only |

|

TZV-MP “Information on the costs of production and sale of products (goods, works and services) and the results of the activities of a small enterprise” |

Legal entities small enterprises (except micro) |

|

|

12-F “Information on the use of funds” |

Medium and large enterprises engaged in the production of goods and services for sale to other legal entities and individuals |

|

|

1-purchase prices “Information on prices (tariffs) for industrial goods and services purchased by agricultural organizations |

Legal entities (except for peasant farms), the main activity of which is the production of agricultural products |

Attention! If the day of submitting the report falls on a weekend or holiday, it is postponed to the next working day.

Organizations and entrepreneurs are required to report to statistical authorities - Rosstat (clause 4 of article 346.11 of the NKRF). Reporting to statistics in 2018 for small businesses consists of several reports.Despite the availability of forms, you may have never submitted a report to a statistical office before. It is explainable. The fact is that the territorial bodies of Rosstat carry out selective statistical observations in relation to small enterprises and individual entrepreneurs. Not everyone must report, but only those included in the sample.

We’ll tell you further how to check if you are on Rosstat’s lists.

All companies submit a balance sheet and financial statements. Let us note that organizations must submit an annual balance sheet, a statement of financial results and appendices thereto to the state statistics authorities at the place of registration (Clause 1 of Article 18 of Federal Law No. 402-FZ).

Thus, a legal copy of financial statements for the year must be submitted no later than three months after the end of the reporting period, that is, before March 31, 2018 inclusive.

Absolutely all companies submit this form. To do this, you do not need to receive any letter from Rosstat. Entrepreneurs do not submit financial statements, since they are not allowed to do accounting.

If you have a micro-enterprise or individual entrepreneur, then you only need to report to “statistics” based on the results of the year. Other small firms report every quarter. In the table, see what forms were submitted by the companies and individual entrepreneurs included in the sample at the beginning of 2018.

Statistical observation can be continuous or selective.

In the first case, all respondents in the study group must submit statistical reporting. For example, if continuous statistical monitoring of activities in the field of trade in motor vehicles is carried out, the established forms of statistical reporting must be submitted by all organizations and entrepreneurs that were assigned OKVED code 50.10 when registering with the territorial division of Rosstat.

If a sample observation is carried out, not all organizations and entrepreneurs that trade in vehicles must submit statistical reports, but only those that, by decision of Rosstat, were included in the sample.

Continuous statistical observations regarding their activities are carried out once every five years (Part 2 of Article 5 of Law No. 209-FZ). The next continuous observation will be in 2021.

In 2018 - only selective observation.

Selective statistical observations are carried out:

1. monthly and (or) quarterly - in relation to small and medium-sized enterprises;

2. annually for micro-enterprises.

The list of small and medium-sized businesses subject to selective statistical observation is determined annually by Rosstat. Only organizations and entrepreneurs that are included in this list should submit statistical reports as part of sample observation.

To accurately determine the composition of your statistical reporting, it is better to immediately contact the territorial division of Rosstat at the place of registration. Informing about what forms need to be submitted and how to fill them out is the direct responsibility of the territorial divisions of Rosstat. Moreover, they are obliged to do this free of charge.

Also, go to the official website of the department. Often the necessary information can be found on the websites of regional branches of Rosstat. They are all presented in the form of an interactive map on the Rosstat portal. Such sites are organized according to a single principle. Thus, in the “Reporting” section there is a special provision for the “Statistical reporting” item. In it you can look at current federal and regional statistical reports, find instructions on how to fill them out and, most importantly, decide whether you need to submit them.

Tables of current statistical reporting forms are also provided on the department’s website. They have been developed and systematized in accordance with the All-Russian Classification of Types of Economic Activities (OKVED).

Forms of statistical reporting are indicated according to the lines of the timesheets. Types of economic activity are shown in the columns of the table; the section number according to OKVED (the first two digits of the OKVED code) is indicated in brackets. The + sign at the intersection of the lines and the graph indicates that an organization or entrepreneur that is engaged in a particular type of activity is required to submit this form of statistical reporting.

This way you can decide on the composition of the statistical reporting of continuous observation.

For selective observation, there are specific forms. Lists of organizations that were included in the sample can also be found on the websites of territorial branches of Rosstat. To do this, go to the “List of reporting business entities” section.

1. List of statistical reports for the year (when and which ones to submit);

2. How to submit a report to statistics for small businesses for the year;

3. What reports do individual entrepreneurs and LLCs submit to statistics in 2018?

In 2018, observation is selective (Clause 1, Article 5 of Federal Law No. 209-FZ). This means that the forms are filled out only by those companies and individual entrepreneurs that were included in the sample.

In the first line, leave “notice for legal entities” if you are an accountant in a company. This value is the default. If you want to find out about individual entrepreneurs’ reports, select in this line “notification for individual entrepreneurs, heads of peasant (farm) farms.”

Next, enter your details. Indicate OKPO, INN or ORGN (for entrepreneurs - OGRIP). You can fill out all the fields or just one of your choice. After that, enter the verification code. These are the numbers that you will see on the screen next to the field.

Click the "search" button. If you specified everything correctly, the search results will appear on the screen. You will see OKPO and the name of your company. Select "Form List". The system will give you the file Statgorms********.pdf. Instead of asterisks in the file name there will be your OKPO code. This notification file specifies which reports and when to submit to “statistics”. See an example of a notification with form names at the top of this page.

If your notification contains only OKPO and the name of the company, you are in luck. This means that you were not included in the sample and do not fill out statistical forms. See an example of a blank notification below.

You can download the reporting forms from the same Rosstat service where you received the notification. Go to the notification file. In the right column of the plate you will find the OKUD report code and the inscription “Download”. Click on this inscription, and another table will appear on your screen. Depending on what kind of report you require, the table will have forms for small businesses, for companies that sell alcohol, etc.

Select the report you need in the new table and click on its code. You will receive the form in text format. Save it to your computer to print or immediately fill out electronically.

You can fill out reports in “statistics” manually and personally bring them to the territorial office of Rosstat. Or you have the right to send a paper report by regular mail by registered mail with notification and a list of the attachments. In the inventory, indicate which forms you are sending.

Another variant. You can fill out an electronic report and send it through the Rosstat website or through a specialized telecom operator. In both cases, you must have an electronic signature certificate.

How to determine key indicators for statistical reports:

|

Index |

How to determine |

|---|---|

|

Average number of employees |

Based on the timesheet data, sum up the number of payroll workers for each day of the period and divide by the number of days in the period* |

|

Average number of employees |

Add up the average number of employees, the average number of external part-time workers and the average number of employees under civil law contracts |

|

Accrued salary fund |

According to accounting data, calculate the turnover from the debit of the expense account (20, 26 or 44) and the credit of account 70. Subtract social payments from this indicator, if any |

|

Social payments |

Sum up severance pay, the cost of gifts given, financial assistance and other similar payments |

|

Number of man-hours worked |

Using the timesheet data, calculate the number of hours worked by all employees of the company |

|

Revenue (net) from the sale of goods, works and services |

Take the figure from the "Revenue" line of the income statement |

|

Shipped goods of own production, performed work and services in-house |

According to accounting data, calculate the turnover on the credit of account 90 of the “Revenue” subaccount. Subtract the proceeds from the sale of purchased goods from this amount. |

|

Sold goods not of own production |

According to accounting data, calculate the turnover on the credit of account 90 of the “Revenue” subaccount in terms of purchased goods sold |

|

Investments in fixed capital |

According to accounting, calculate the turnover from the debit of account 01 |

If you are included in the sample, but did not submit the required report, you will be fined under Article 13.19 of the Code of Administrative Offenses of the Russian Federation. For officials and entrepreneurs, the amount of sanctions is from 10,000 to 20,000 rubles. For organizations - from 20,000 to 70,000 rubles. The exact amount will be determined by the head or deputy of the territorial body of Rosstat (Part 2 of Article 23.53 of the Code of Administrative Offenses of the Russian Federation).

If you have not submitted your company’s accounting records to “statistics,” you may face sanctions under Article 19.7 of the Code of Administrative Offenses of the Russian Federation. For company officials, this is a fine of 300 to 500 rubles. or warning. Plus, the organization itself will be subject to a fine of 3,000 to 5,000 rubles. The violation protocol is drawn up by specialists from Rosstat (Article 28.3 of the Code of Administrative Offenses of the Russian Federation). And the amount of the fine will be set by the magistrate (Part 1 of Article 23.1 of the Code of Administrative Offenses of the Russian Federation and letter of Rosstat No. 13-13-2/28-SMI).

For failure to submit statistical reports, firms face an administrative fine of up to 70,000 rubles, and for an unsubmitted balance - up to 5,000 rubles. (Articles 13.19 and 19.7 of the Code of Administrative Offenses of the Russian Federation).

If you are an accountant at a firm that was included in the statistical sample, be careful. For accounting and statistical reporting not submitted to Rosstat on time, two types of administrative fines are imposed. Under articles 13.19 and 19.7 of the Code of Administrative Offenses of the Russian Federation. So find out in advance what reports are expected of you. And submit all forms on time.

Submission of statistical reporting in 2018

To find out the list of forms and deadlines for submitting reports to statistics in 2018, see the table in the article. It is relevant for all companies, including those on the simplified tax system and small enterprises.The set of statistical reporting forms depends on:

From the recipient of the information (most often Rosstat and regional offices);

location of the organization and type of activity (there are federal and regional forms, general and sectoral, one-time or periodic);

depends on the type of observation within which the report must be submitted - continuous or selective.

In the table at the end of the article you will find a list of common forms of statistical reporting.

Rosstat also approved special forms for small businesses. Among them:

No. MP(micro) “Information on the main performance indicators of a micro-enterprise”;

No. 1-IP “Information on the activities of an individual entrepreneur”;

No. PM “Information on the main performance indicators of a small enterprise.”

These forms, as well as industry reporting to statistics in 2018, are mandatory only for those entrepreneurs, small and micro enterprises that are included in the Rosstat sample.

Most simplified companies are small or micro enterprises. Therefore, they submit statistical reports the same as small businesses - forms No. MP (micro) or No. PM.

Each company can check what statistics it reports in 2018 personally. Comprehensive information is available in the statreg.gks.ru service. If you do not submit reports from this list, you will be fined.

The list of forms is updated monthly. The department employees themselves use it to find out which report to expect from which company. If you fail to report, the company may be fined a large amount. The standard fine is up to 70,000 rubles, and for a repeated violation - up to 150,000 rubles. (Article 13.19 of the Code of Administrative Offenses of the Russian Federation).

Go to statreg.gks. In the search card, fill out three fields:

"Notification type";

TIN (or OGRN);

security code.

Click the "Search" button and you will see the name of the organization. Next to it there will be a “List of Forms” button. Click on it and get a list of statistical reports specifically for your company. It contains not only the name, but also the frequency and due date. You can also download each form there.

Rosstat confirmed that the list of reports in the service is exhaustive. The company does not have to submit any other forms. There is only one exception - if Rosstat separately informed the organization about additional reporting by letter, by phone or by email.

To insure yourself in case of a dispute with Rosstat employees, save the list that the system produces. To do this, take and certify a screenshot of the screen. Department specialists confirmed that a correctly certified screenshot can be used as a supporting document.

It's easy to form. Press the PrintScreen or PrtScn button on your keyboard. Then open Word and press Ctrl + V. A photo of the Internet page will appear in the file. Save this file and then print the picture.

To certify your printout, please include:

Date and time when the screenshot was taken;

site name - statreg.gks.ru;

FULL NAME. the employee who displayed and printed the screenshot;

information about the program with which it was generated.

It makes no sense for existing organizations to check information frequently. Rosstat suggests doing this once at the end of the year in order to receive a list with reports for the next one. But for new companies, it is safer to log into the service monthly during the first year of operation.

Forms of statistical reporting in 2018:

|

Statistical reporting form |

Reporting deadline |

Rosstat document approving the form |

|

Information about the activities of the organization |

||

|

Basic information about the activities of the organization (1-enterprise) 0601009 |

||

|

Information on the main performance indicators of a microenterprise (MP (micro)) 0601016 |

||

|

Basic information about the activities of the organization (P-5 (m)) 0610016 |

||

|

Information on the costs of production and sale of products (goods, works, services) (5-Z) 0608014 |

Until the 30th day after the reporting quarter (inclusive) Presented for the first quarter, first half of the year, nine months of the year |

Order No. 320 |

|

Information on the main performance indicators of a small enterprise (PM) 0601013 |

Until the 29th day after the reporting quarter (inclusive) |

|

|

Information on the use of intellectual property (4-NT (list)) 0604013 |

||

|

Information on the activities of publishing books (1-I) 0609503 |

Until the 5th day after the reporting quarter (inclusive) |

Resolution No. 162 |

|

Information on the activities of publishing periodical printed media (1-I (mass media)) 0609516 |

Resolution No. 162 |

|

|

Information on the activities of the insurer (1-SK) 0608012 |

On the 35th day after the reporting quarter |

Order No. 434 |

|

Information on the use of fuel and energy resources (4-TER) 0610068 |

||

|

Information on fuel reserves (4-reserves) 0607019 |

Until the 2nd day after the reporting month (inclusive) |

Order No. 327 |

|

Information on the use of information and communication technologies and the production of computer equipment, software and the provision of services in these areas (3-inform) 0604018 |

||

|

Information about the activities of a socially oriented non-profit organization (1-SONKO) 0608028 |

||

|

Information on the activities of the self-regulatory organization of auditors (3-audit) 0609712 |

Order No. 759 |

|

|

Information about the activities of the entrepreneur |

||

|

Information on production of products by an individual entrepreneur (1-IP (month)) 0610001 |

||

|

Information on the volume of paid services provided to the population by an individual entrepreneur (No. 1-IP (services)) 0609709 |

||

|

Questionnaire for surveying the transportation activities of entrepreneurs - owners of trucks (No. 1-IP (truck)) 0615069 |

Quarterly |

Order No. 527 |

|

Information on the activities of an individual entrepreneur (1-IP) 060101 |

||

|

Information on the production of products by a micro-enterprise (MP (micro)-nature) 0601024 |

||

|

Information about production and services |

||

|

Information about technological innovations of a small enterprise (2-MP innovation) 0601011 |

Until April 9 after the reporting year (inclusive) - once every 2 years for odd-numbered years from the report in 2018 |

|

|

Information on the volume of paid services to the population (1-services) 0609703 |

||

|

Information on the production and shipment of goods and services (P-1) 0610013 |

On the 4th working day after the reporting month (inclusive) |

|

|

Information on the production of military (defense) products (Appendix 2 to form No. P-1) 0610054 |

On the 4th working day after the reporting month (inclusive) |

|

|

Information on the volume of paid services to the population by type (P (services)) 0609707 |

Until the 4th day after the reporting month (inclusive) - if until the 15th day after the reporting quarter (inclusive) - with an average number of employees of no more than 15 people |

|

|

Survey of business activity in the service sector (1-DA (services)) 0609708 |

On the 15th day of the second month of the reporting quarter |

|

|

Information on producer prices of industrial goods (services) (1-producer prices) 0616007 |

|

|

|

Information on the production of products by a small enterprise (PM-prom) 0610010 |

On the 4th working day after the reporting month (inclusive) |

|

|

Information on average prices for grain purchased by industrial organizations for main production (2-purchase prices (grain)) 0616021 |

Until the 15th day after the reporting month (inclusive) |

Order No. 390 |

|

Information on purchase prices of certain types of goods (2-purchase prices) 0616008 |

Until the 18th day after the reporting month (inclusive) |

Order No. 390 |

|

Information on producer prices for mineral fertilizers (1-producer prices (fertilizers)) 0616022 |

Until the 22nd day of the reporting month (inclusive) |

Order No. 390 |

|

Survey of business activity of organizations in mining, manufacturing, production and distribution of electricity, gas and water (1-DAP) 0610019 |

Until the 10th day of the reporting month (inclusive) |

|

|

Survey of business activity of small enterprises in mining, manufacturing, production and distribution of electricity, gas and water (DAP-PM) 0610017 |

Until the 10th day of the last month of the reporting quarter (inclusive) |

|

|

Information on production, shipment of products and balance of production capacity (1-natura-BM) 0610035 |

||

|

Information on the production and shipment of composite materials (attachment to form No. 1-Natura-BM) 0610034 |

||

|

Information on the production of DOC and PSF chemicals subject to declaration and control under the Convention (1-ХО) 0610086 |

||

|

Information on the production and consumption of chemicals of lists 2 and 3, subject to declaration and control under the convention (2-ХО) 0610087 |

||

|

Information on audit activities (2-audit) 0609711 |

Order No. 740 |

|

|

Information about stationary social service organizations for elderly citizens and disabled people (adults and children) (3-social security (consolidated)) 0609318 |

||

|

Information on production, shipment and prices for medicines (2-LEK (industrial)) 0610032 |

||

|

Information on the release and shipment of medical products (medical equipment and medical devices) (1-medical products) 0610082 |

On the 20th day after the reporting quarter |

|

|

Information on the production and shipment of folk arts and crafts products by a small enterprise (P-NHP-M) 0610099 |

Until the 15th day after the reporting quarter (inclusive) |

Order No. 855 |

|

Information on the shipment of goods, works and services related to nanotechnology (1-NANO) 0610012 |

Until the 30th day after the reporting quarter (inclusive) |

Order No. 414 |

|

Information on the production and supply of military (defense) products (1-PO) 0610053 |

No later than the 5th day after the reporting month |

|

|

Information on residues of explosive materials for industrial use (1-VM (urgent)) 0607033 |

Order No. 189 |

|

|

Information on the production, shipment and balances of explosive materials for industrial use (1-PS (urgent)) 0610033 |

On the 5th day after the reporting month |

Order No. 189 |

|

Information on the cost and profitability of military (defense) products (1-SR) 0610052 |

Order No. 502 |

|

|

Information on the production of rocket and space technology (1-RKT) 0610100 |

Until the 30th day after the reporting quarter (inclusive) |

Order No. 182 |

|

Information on fish catch, extraction of other aquatic biological resources and withdrawal of objects of commercial aquaculture (commercial fish farming) (1-P (fish)) 0610075 |

Until the 30th day after the reporting quarter, for January-December - until February 15 (organizations and individual entrepreneurs) |

|

|

Information on the current market value of mineral reserves (1-RSPI) 0609062 |

||

Deadlines for submitting statistical reports in 2018

Late submission of reports on taxes and contributions threatens companies and individual entrepreneurs not only with fines, but also with blocking of current accounts. To avoid such troubles, follow the established deadlines. To help you - Accountant's Calendar: table of reporting deadlines in 2018.In order to submit reports on time to the Federal Tax Service, Pension Fund and Social Insurance Fund this year, see the reporting dates in the Accountant's Calendar 2018. Focus on the specified deadline and, if possible, submit reports as soon as the reporting campaign begins.

In 2018, organizations and individual entrepreneurs submit to the Federal Tax Service not only tax returns and calculations, but also reports on insurance premiums. See the table with reporting deadlines (taking into account transfers from holidays and weekends).

In it you will also find deadlines for submitting reports in 2018:

|

Reporting type |

Reporting/tax period |

Deadline for submission to the Federal Tax Service |

|---|---|---|

|

Information on the average number of employees |

||

|

De-cla-ra-tion according to the log of profit with quarterly reporting |

||

|

1st quarter 2018 |

||

|

2nd quarter (half year) 2018 |

||

|

3rd quarter (9 months) 2018 |

||

|

De-cla-ra-tion according to the log for profit with monthly reporting |

||

|

Jan-Var 2018 |

||

|

February 2018 |

||

|

March 2018 |

||

|

Apr-Rel 2018 |

||

|

June 2018 |

||

|

July 2018 |

||

|

Aug-Aug 2018 |

||

|

September 2018 |

||

|

October-October 2018 |

||

|

Nov-Nov 2018 |

||

|

VAT declara-tion |

Q4 2017 |

|

|

1st quarter 2018 |

||

|

Journal of accounting for received and issued invoices |

Q4 2017 |

|

|

1st quarter 2018 |

||

|

2nd quarter (half year) 2018 |

||

|

3rd quarter (9 months) 2018 |

||

|

Certificates 2-ND-FL |

2017 (if it is impossible to withhold personal income tax) |

|

|

2017 (for all income paid) |

||

|

Calculation 6-ND-FL |

||

|

1st quarter 2018 |

||

|

2nd quarter (half year) 2018 |

||

|

3rd quarter (9 months) 2018 |

||

|

Declaration of tax on the property of organizations |

||

|

Advance payment for tax deductions for property of organizations |

1st quarter 2018 |

|

|

2nd quarter (half year) 2018 |

||

|

3rd quarter (9 months) 2018 |

||

|

Declaration according to the simplified tax system |

2017 (organizations) |

|

|

Declaration of UTII |

Q4 2017 |

|

|

1st quarter 2018 |

||

|

2nd quarter (half year) 2018 |

||

|

3rd quarter (9 months) 2018 |

||

|

Declaration according to the Unified Agricultural Tax |

||

|

De-cla-ra-tion for transport-port-no-mu na-lo-gu (or-ga-ni-za-tion) |

||

|

De-kla-ra-tion according to the land-no-mu na-lo-gu (or-ga-ni-za-tion) |

||

|

Unified simplified de-cla-ra-tion |

||

|

1st quarter 2018 |

||

|

2nd quarter (half year) 2018 |

||

|

3rd quarter (9 months) 2018 |

||

|

Declaration 3-NDFL (IP) |

This year, organizations and individual entrepreneurs submit a single calculation of insurance premiums for contributions to the tax office.

The deadline is the same for everyone and does not depend on the delivery format:

To the Pension Fund of the Russian Federation, organizations and individual entrepreneurs submit several types of reports in 2018: monthly information about insured persons in the SZV-M form, information about the insurance length of employees in the SZV-STAZH form, if the employee retires, information about the length of service in the SZV-STAZH form.

See the dates in the table:

|

Report view |

Period |

Deadline for submission to the Pension Fund |

|---|---|---|

|

Information about the length of service in the form SZV-STAZH |

||

|

Information about insured persons according to the SZV-M form |

December 2017 |

|

|

Jan-Var 2018 |

||

|

February 2018 |

||

|

March 2018 |

||

|

Apr-Rel 2018 |

||

|

June 2018 |

||

|

July 2018 |

||

|

Aug-Aug 2018 |

||

|

September 2018 |

||

|

October-October 2018 |

||

|

Nov-Nov 2018 |

||

|

Information about work experience until 2002 in the form SZV-K |

At the request of the fund |

|

In 2018, policyholders confirm their main type of activity with the Social Insurance Fund and submit quarterly and annual payments in accordance with Form 4-FSS:

This year, organizations also need to submit financial statements for the past year to the Federal Tax Service and Rosstat.

See the dates in the table:

Statistical reporting forms in 2018

Rosstat, by order of August 24, 2017 No. 545, updated the following forms of federal statistical monitoring of agriculture and the environment:Annual from the 2017 report:

No. 4-OS “Information on current costs for environmental protection”;

No. 1-SPNA “Information on specially protected natural areas”;

No. 1-ЛХ “Information on forest reproduction and afforestation”;

No. 12-LKH “Information on forest protection”;

No. 2-TP (hunting) “Information on hunting and hunting management”;

No. 5-SB “Information on the processing of potatoes, vegetables and fruit and berry products”;

No. 21-СХ “Information on the sale of agricultural products”;

Appendix to form No. 21-СХ “Information on the export of agricultural products” and others;

A new form of monthly report is also being introduced from January 2018 No. 2 “Production of agricultural products in personal subsidiary plots and other individual farms of citizens”, monthly - from the report for January 2018, annual from the report for 2017 No. 3-farmer “Information on production livestock and livestock numbers."

Forms have also been updated from reports in 2018:

No. 2-farmer “Information on harvesting agricultural crops”;

No. 10-MEKH (brief) “Information on the availability of tractors, agricultural machines and energy capacities.”

Previously existing forms of statistical reporting were recognized as not subject to application.

In 2018, information on headcount and wages is submitted in form P-4 to the statistical authorities. Check whether your company is required to submit this report and what deadlines must be met. And also look at the instructions for filling out form P-4 for submission to Rosstat in 2018.

Companies submit form P-4 statistics in 2018 to report information on headcount and wages to Rosstat authorities. Almost all companies must submit this form: both commercial and budgetary. In 2018, companies report in Form P-4, approved. by order of Rosstat dated September 1, 2017 No. 566.

A separate form is filled out for all separate divisions, regardless of whether they are indicated or not in the constituent documents.

The following companies are exempt from the obligation to submit form P-4 statistics in 2018:

Small business;

those who submit T-1 forms to the statistical authorities.

Please note that you must submit Form P-4 even if you do not accrue or pay wages. This fact does not exempt you from submitting reports.

The deadline for submitting Form P-4 in 2018 depends on how many people work in your company. If the number:

More than 15 people - the report is submitted monthly no later than the 15th day of the month following the reporting one;

less than 15 people - P-4 in 2018 is due quarterly, no later than the 15th day of the month following the reporting quarter.

We have compiled a detailed table with deadlines for submitting form P-4 statistics in 2018:

|

Average headcount |

How long |

|---|---|

|

more than 15 people |

for January 2018 - 02/15/2018; for February 2018 - 03/15/2018; for March 2018 - 04/16/2018; for April 2018 - 05/15/2018; for May 2018 - 06/15/2018; for June 2018 - 07/16/2018; for July 2018 - 08/15/2018; for August 2018 - 09/17/2018; for September 2018 - 10/15/2018; for October 2018 - November 15, 2018; for November 2018 - December 17, 2018; for December 2018 - 01/15/2019. |

|

15 people or less |

for the first quarter of 2018 - 04/16/2018; for the second quarter of 2018 - 07/16/2018; for the third quarter of 2018 - October 15, 2018; for the fourth quarter of 2018 - 01/15/2019. |

If the company violates the deadline or does not submit Form P-4 to the statistical authorities in 2018, then it will be necessary to pay a fine.

The fine is set as follows:

For the head of a company - from 10 to 20 thousand rubles;

for a company – from 20 to 70 thousand rubles.

For repeated violations, the fine will be increased:

For a manager - from 30 to 50 thousand;

for a company – from 100 to 150 thousand.

The rules for filling out P-4 statistics are specified in Rosstat order No. 498 (as amended on 02/06/2017). See detailed instructions with an example of filling out the form.

In the appropriate lines, indicate:

Full and short name of the company;

The actual location of the organization, its postal address;

OKPO code.

If there have been any changes in these data compared to the previous reporting period, please provide an explanation to the form.

We have given an example of filling out form P-4 below.

Fill out the tabular part of form P-4 in 2018 in the order indicated below:

Column A – indicate the type of activity of the company (each type has its own line and its own data);

- Column B – OKVED code for this type of activity;

- Column 1 – total average number of employees;

- Columns 2-4 – we decipher the number of employees indicated in column 1 by category:

payroll employees without external part-time workers (internal part-time workers are considered at the basic rate);

external part-time workers (counted in proportion to time worked);

working under a civil contract (counted according to the days the contract is valid);

- Columns 5-6 – we write the actual number of man-hours for payroll employees and external part-time workers (the indicator does not include vacationers taking exams, improving their qualifications outside of work, or on sick leave);

- Column 7 – the total amount of accrued wages and all kinds of payments minus personal income tax and other deductions provided for by law;

- Columns 8-10 – breakdown of the amount indicated in column 7 by employee category;

- Column 11 – write the amount of social payments, including financial assistance, incentives, dismissal and retirement benefits, payment for treatment, study, etc.

Do not indicate in P-4 the amounts of insurance premiums, contributions for injuries, sick leave and travel allowances.

Statistical reporting forms in 2018 by TIN

You can find out the organization’s statistics codes by TIN on your own and without submitting an official request to Rosstat. In this material you will find several search methods and step-by-step instructions for them. You can find out the statistics codes by TIN on the official website of Rosstat - the service for generating notifications launched on the state portal not so long ago. In addition, there are programs that help you find information about organizations and entrepreneurs on the Internet - services for checking counterparties.With their help, you can find out not only the details of your partner, but also check his reliability in order to eliminate risks during cooperation. Statistical codes will be needed for: submitting reports; filling out payment documents; opening a current account; opening a separate division; and in other cases. The official document containing the required values is the Statistical Register of Business Entities of the Federal State Statistics Service.

There are 7 such codes in total:

OKPO - All-Russian Classifier of Enterprises and Organizations;

OKATO - All-Russian Classifier of Objects of Administrative-Territorial Division;

OKTMO - All-Russian Classifier of Municipal Territories;

OKOGU - All-Russian Classifier of State Power and Management Bodies;

OKFS - All-Russian classifier of forms of ownership;

OKOPF - All-Russian Classifier of Organizational and Legal Forms;

OKVED - All-Russian Classifier of Types of Economic Activities.

However, OKVED, despite its statistical function, refers to state registration data. Therefore, it is contained in an extract from the Unified State Register of Legal Entities or Unified State Register of Individual Entrepreneurs and is searched in another way (instructions for searching OKVED are given here). And OKATO is becoming obsolete - instead of it, all payment documents and declarations now indicate OKTMO, which can be found using OKATO. Therefore, there are 5 main statistical codes.

Find out statistics codes by TIN using the Rosstat service:

1. The official website of Rosstat finds statistics codes by TIN when generating a notification. There are many sites that help you find statistics codes by TIN online in Moscow and the Moscow region, as well as in other regions. However, such a territorial search comes down to the same page - the Rosstat service for generating notifications. After following the link, enter the TIN in the line, the remaining fields can be left blank, indicate that you are not a robot and click "Search".

2. When searching for the details of a large company, the results will show the parent company and all separate divisions registered under this TIN. Geographically, the divisions are located in different places, so their data differs. Select the desired division or main legal entity, which will be first in the list, and click the "OK TEI Codes" button. Back | |

In 2019, for violation of deadlines for submitting statistical reports in 2019, fines of up to 150 thousand rubles are provided. There are a lot of reports and in order not to get confused, use a ready-made calendar with an up-to-date list of reporting forms for statistics and deadlines for submitting them for a specific enterprise according to the Taxpayer Identification Number (TIN).

In 2019, companies and entrepreneurs, state and local government bodies, as well as representative offices of foreign organizations operating in the Russian Federation are required to submit reports to Rosstat in 2019.

The obligation remains even in cases where there is actually no information. The only difference is that the absence of indicators must be reported to statistics by letter (Rosstat letter dated January 22, 2018 No. 04-4-04-4/6-smi).

See the list of reports and deadlines for their submission to Rosstat.

Statistical reporting in 2019: deadlines

Statistical reporting forms are updated monthly. So regularly keep track of which report needs to be filed and when. The forms differ from each other and depend on a number of criteria:

- from the recipient of statistical information (Rosstat or its regional branch);

- location of the company and type of its activities (general and industry, etc.);

- type of observation - continuous or selective.

For efficiency, use a calendar or a special table (see below) with all forms of statistical reporting and deadlines for their submission.

If the last day of the deadline for submitting statistical reports falls on a non-working day, the end of the deadline is considered to be the next working day (Resolution of the State Statistics Committee of the Russian Federation dated 03/07/2000 N 18).

The department's position on this issue has changed several times, so it is safer to report the day before - before a holiday or weekend.

The main thing is not to get confused among the many forms of statistical reporting in 2019. As an assistant, you can use the Rosstat service https://websbor.gks.ru. The service is simple: follow the link and fill out the fields provided. In the top field, select for whom the notification is generated:

- legal entities;

- branches, representative offices;

- Individual entrepreneur, peasant farm;

- lawyer/private notary.

Next, enter one of the known details: OKPO, INN and OGRN of the company. Next, enter the numbers from the picture in a separate field. When you enter numbers, the service will check whether the search parameters are correct. If the details match, then click the “Search” button (see the figure below).

How to check by TIN which reports to submit to statistics in 2019

After this, the service will instantly process the request and provide an individual result suitable specifically for your company. The reporting list can be downloaded as a PDF document. In addition, here you can download the blank form for each of the reports.

This service is also used by the controllers themselves, since it contains the most up-to-date information. Inspectors formulate a request and check what reports the company must submit and when. If an organization does not submit statistical reports on time, fines are possible. Moreover The fines are impressive - up to 150 thousand. rubles(Article 13.19 of the Code of Administrative Offenses of the Russian Federation).

If you doubt the service, make an official request to the statistics. To do this, you need to issue a letter to Rosstat with a request to clarify the list of forms that the company is required to submit. Apply the department’s response in your work. Controllers must provide a ready list of all reporting forms to Rosstat in 2019 according to your TIN. This is convenient, so you definitely won’t make a mistake, and there will be no fines.

If a company does not have indicators for any reporting period, then the obligation to submit reports remains. But in this case there is no need to submit an empty form. Instead, send a letter to the department about the absence of certain indicators. This way, statisticians will know that the company does not have the opportunity to fill out and submit statistical reports (Rosstat letter No. 04-4-04-4/6-smi dated January 22, 2018).

Companies are required to submit financial statements annually. Now the balance is submitted to two departments - the inspectorate and Rosstat (subparagraph 5, paragraph 1, article 23 of the Tax Code, article 18 of the Federal Law of December 6, 2011 No. 402-FZ). Deadline: no later than March 31st.

Soon the rules will change; only tax officials will maintain the accounting database. Rosstat will stop accepting balance sheets. However, the amendments will come into force only in a year, more precisely, from January 1, 2020. That's why report for the current year as before.

Inspections will only accept balances electronically. For large and medium-sized companies, the change applies starting from the 2019 report, for small companies - from the 2020 report.

List of forms and deadlines for submitting reports to statistics in 2019: table

|

Statistical reporting form(you can download current forms. To do this, click on the link) |

Reporting period |

Deadline |

Order (resolution) of Rosstat |

|---|---|---|---|

|

INFORMATION ABOUT THE ACTIVITIES OF THE ORGANIZATION |

|||

|

Basic information about the activities of the organization (1-enterprise) 0601009 |

dated 07/27/18 No. 461 |

||

|

On the main performance indicators of a microenterprise (MP (micro)) 0601016 |

dated 07/27/18 No. 461 |

||

|

On the production of products by a micro-enterprise (MP (micro)-nature) 0601024 |

dated 07/27/18 No. 461 |

||

|

Basic information about the activities of the organization (P-5 (m)) 0610016 |

Until the 30th |

dated 07/31/18 No. 472 |

|

|

On the costs of production and sale of products (goods, works, services) (5-З) 0608014 |

Until the 30th |

from 07/15/15 No. 320 |

|

|

On the main performance indicators of a small enterprise (PM) 0601013 |

Until the 29th |

dated 07/27/18 No. 461 |

|

|

On the use of intellectual property (4-NT (list)) 0604013 |

from 05.12.17 No. 805 |

||

|

On the activities of publishing books (1-I) 0609503 |

Until the 5th |

||

|

On the activities of publishing periodical printed media (1-I (mass media)) 0609516 |

half year |

Resolution dated December 31, 2004 No. 162 |

|

|

About the activities of the insurer (1-SK) 0608012 |

quarter/year |

from 01/23/18 No. 23 |

|

|

On the use of fuel and energy resources (4-TER) 0610068 |

dated 07/27/18 No. 461 |

||

|

About fuel reserves (4-reserves) 0607019 |

dated 07/06/16 No. 327 |

||

|

On the use of information and communication technologies and the production of computer equipment, software and the provision of services in these areas (3-inform) 0604018 |

from 06.08.18 No. 487 |

||

|

About the activities of a socially oriented non-profit organization (1-SONKO) 0608028 |

from 04.09.18 No. 540 |

||

|

On the activities of the self-regulatory organization of auditors (3-audit) 0609712 |

from 02.12.16 No. 759 |

||

|

On the implementation of state control (supervision) and municipal control (1-control) 0605137 |

half year |

Until the 15th day after the reporting half-year; until the 20th day after the reporting half-year; |

dated December 21, 2011 No. 503 |

|

INFORMATION ABOUT THE ACTIVITIES OF IP |

|||

|

On the production of products by an individual entrepreneur (1-IP (month)) 0610001 |

dated 07/31/18 No. 472 |

||

|

On the volume of paid services provided to the population by individual entrepreneurs (No. 1-IP (services)) 0609709 |

dated 08/31/17 No. 564 |

||

|

Questionnaire for surveying the transportation activities of entrepreneurs - owners of trucks (No. 1-IP (truck)) 0615069 |

Deadlines are set by Rosstat |

dated 08/19/14 No. 527 |

|

|

On the activities of an individual entrepreneur (1-IP) 060101 |

from 08/21/17 No. 541 |

||

|

On the production of products by a micro-enterprise (MP (micro)-nature) 0601024 |

dated 07/27/18 No. 461 |

||

|

INFORMATION ABOUT PRODUCTION AND SERVICES |

|||

|

On technological innovations of small enterprises (2-MP innovation) 0601011 |

Until April 9 after the reporting year (inclusive) - once every 2 years for odd-numbered years from the report in 2018 |

dated 08/30/17 No. 563 |

|

|

On the volume of paid services to the population (1-services) 0609703 |

dated 08/31/17 No. 564 |

||

|

On the production and shipment of goods and services (P-1) 0610013 |

dated 07/31/18 No. 472 |

||

|

On the production of military (defense) products (Appendix 2 to form No. P-1) 0610054 |

On the 4th working day after the reporting month (inclusive) |

dated 07/31/18 No. 472 |

|

|

On the volume of paid services to the population by type (P (services)) 0609707 |

month/quarter |

Until the 4th day after the reporting month - if until the 15th day after the reporting quarter - with an average number of employees of no more than 15 people |

dated 08/31/17 No. 564 |

|

Survey of business activity in the service sector (1-DA (services)) 0609708 |

On the 15th day of the second month of the reporting quarter |

dated 08/31/17 No. 564 |

|

|

On producer prices of industrial goods (services) (1-producer prices) 0616007 |

month year |

dated 07/31/18 No. 468 |

|

|

On the production of products by a small enterprise (PM-prom) 0610010 |

On the 4th working day after the reporting month |

dated 07/31/18 No. 472 |

|

|

On average prices for grain purchased by industrial organizations for main production (2-purchase prices (grain)) 0616021 |

Until the 15th |

dated 07/31/18 No. 468 |

|

|

On purchase prices of certain types of goods (2-purchase prices) 0616008 |

Until the 18th |

dated 08/22/18 No. 512 |

|

|

On producer prices for mineral fertilizers (1-producer prices (fertilizers)) 0616022 |

Until the 22nd |

from 05.08.16 No. 390 |

|

|

Survey of business activity of organizations in mining, manufacturing, production and distribution of electricity, gas and water (1-DAP) 0610019 |

Until the 10th |

dated 07/27/18 No. 461 |

|

|

Survey of business activity of small enterprises in mining, manufacturing, production and distribution of electricity, gas and water (DAP-PM) 0610017 |

Until the 10th |

dated 07/27/18 No. 461 |

|

|

On production, shipment of products and balance of production capacity (1-natura-BM) 0610035 |

dated 07/27/18 No. 461 |

||

|

On the production and shipment of composite materials (attachment to form No. 1-Natura-BM) 0610034 |

from 08/21/17 No. 541 |

||

|

On the production of DOC and PSF chemicals subject to declaration and control under the Convention (1-ХО) 0610086 |

dated 07/27/18 No. 461 |

||

|

On the production and consumption of chemicals of lists 2 and 3, subject to declaration and control under the convention (2-ХО) 0610087 |

dated 08/28/17 No. 552 |

||

|

About audit activities (2-audit) 0609711 |

from 23.11.16 No. 740 |

||

|

On stationary social service organizations for elderly citizens and disabled people (adults and children) (3-social security (consolidated)) 0609318 |

from 06.10.17 No. 662 |

||

|

On the production, shipment and prices of medicines (2-LEK (industrial)) 0610032 |

On the 20th day |

from 04.14.17 No. 240 |

|

|

On the release and shipment of medical products (medical equipment and medical devices) (1-medical products) 0610082 |

On the 20th day |

from 04.14.17 No. 240 |

|

|

On the production and shipment of folk art crafts by a small enterprise (P-NHP-M) 0610099 |

Until the 15th |

dated 12/26/16 No. 855 |

|

|

On the shipment of goods, works and services related to nanotechnology (1-NANO) 0610012 |

Until the 30th |

dated 07/27/18 No. 461 |

|

|

On the production and supply of military (defense) products (1-PO) 0610053 |

No later than the 5th |

from 09/07/17 No. 577 |

|

|

On residues of explosive materials for industrial use (1-VM (urgent)) 0607033 |

On the 5th day |

dated 08/31/09 No. 189 |

|

|

On the production, shipment and residues of explosive materials for industrial use (1-PS (urgent)) 0610033 |

On the 5th day |

dated 08/31/09 No. 189 |

|

|

On the cost and profitability of military (defense) products (1-SR) 0610052 |

from 07.08.14 No. 502 |

||

|

Until the 30th |

dated 08/25/09 No. 182 |

||

|

On fish catch, extraction of other aquatic biological resources and withdrawal of objects of commercial aquaculture (commercial fish farming) (1-P (fish)) 0610075 |

Until the 30th day after the reporting quarter, for January-December - until February 15 (organizations and individual entrepreneurs) |

dated 04/25/17 No. 291 |

|

|

On the current market value of mineral reserves (1-RSPI) 0609062 |

from 12/25/17 No. 863 |

||

The obligation to submit statistical reporting follows from the norms of Federal Law No. 282-FZ dated November 29, 2007, as well as Rosstat Order No. 414 dated August 11, 2016. The report forms themselves, as well as the rules for their execution, are approved by departmental orders. Let's talk about the features of statistical reporting in 2019 for organizations and individual entrepreneurs.

Reporting to Rosstat for 2018 for small enterprises

Statistical reporting forms are divided into mandatory and additional, which need to be submitted only during a random check by Rosstat. Please note that only small or medium-sized businesses are subject to such an audit. The department creates a list of them in advance.

When preparing statistical reporting, observe the specifics for your business status. For example, small and micro companies fill out information about the main indicators “MP (micro)” or “PM”, and entrepreneurs when sampling - “1-IP” (see table). At the same time, individual entrepreneurs and micro-companies submit reports once a year, and the rest - quarterly. Find out in Table 2 what reports companies and individual entrepreneurs submit when selected by Rosstat.

Forms of statistical reporting for small enterprises during selective observation by Rosstat

| Enterprise status | Statistical reporting form | Due dates |

| IP | 1-IP, approved by order of Rosstat dated August 21, 2017 No. 541 | 2nd of March |

| Microenterprises | MP (micro), approved. by order of Rosstat dated August 21, 2017 No. 541 | February 5th |

| Small organizations | PM, approved by order of Rosstat dated August 11, 2016 No. 414 | January 29 |

Reporting to Rosstat in 2019 for LLCs using the simplified tax system

The use of a special regime does not relieve the company from the need to report to statistics in 2019. For simplified companies, this obligation follows from paragraph 4 of Article 346.11 of the Tax Code of the Russian Federation. Therefore, it is necessary to comply with the same requirements established by the legislation on the submission of statistical reporting.

Most LLCs on the simplified tax system are classified as small or micro enterprises. Therefore, in 2019, such enterprises need to submit reports in the same way as small businesses - submit the “MP” or “PM” forms (see above).

Responsibility for violation of deadlines for submitting statistics in 2019

It is dangerous to ignore the obligation to submit statistical reports. Since for violation of the submission deadline, as well as failure to submit reports, controllers may be fined. The sanction is provided for in Article 13.19 of the Code of Administrative Offenses of the Russian Federation. Moreover, a fine is possible not only for the company as a whole, but also for officials who are responsible for submitting reports to statistics. For example, the director or chief accountant can be fined. The fine is significant - from 10 to 20 thousand rubles (see table below).

Responsibility for late submission of financial statements follows from Article 19.7 of the Code of Administrative Offenses of the Russian Federation. For example, controllers can fine the chief accountant in the amount of 300 to 500 rubles, and the company in the amount of 3 to 5 thousand rubles. The amount of the fine will be established by the court (Part 1 of Article 23.1 of the Code of Administrative Offenses of the Russian Federation, letter of Rosstat dated February 16, 2016 No. 13-13-2/28-SMI).

Fines for violating deadlines for submitting reports to statistics in 2019

Read also...

- Russian folk tales about winter

- Correspondence of Tatyana Golikova: the Russian Federation SP exposed the Prime Minister of Ingushetia in malicious violations

- A major official appeared in the case of Zakharchenko’s father

- A Kharkov woman managed to “pierce the armor”: what is known about the personal life of Dmitry Maryanov Who did Evgenia Brik meet with?