Simplified balance sheet. The procedure for filling out the balance sheet and financial performance report. The procedure for filling out the balance sheet in a general form. Example What is included in line 1310 of an NPO balance sheet

Since it is the main type of accounting reporting, it carries a meaning dedicated to the financial condition of the business entity. At the same time, a beginner may find its structure incomprehensible and confusing, because in addition to complex page numbering, one also has to deal with the concept of codes, which sometimes becomes a whole problem. This article is devoted to decoding the lines of the balance sheet.

Download the form Balance sheet (form according to OKUD 0710001) possible by .

Simplified form of Balance available at .

Let's look at all the balance line codes by section.

Section 1 - Non-current assets

This section contains information about what low-liquidity assets the company owns. Usually these are equipment, premises, buildings, intangible assets and others.

Section 2 - Current assets

Current assets are the most highly liquid assets of an enterprise. These include goods, accounts receivable, money in cash and accounts, etc.

Section 3 - Capital and reserves

Section 4 - Long-term liabilities

Section 5 - Current Liabilities

Assignment of codes and numbers

Codes for certain lines must be indicated in a certain column. It is worth noting that codes are needed mainly so that statistical authorities can combine information presented in different types of balance sheets into one whole. The codes are mandatory to fill out when the balance sheet being compiled must be transferred to state executive structures with further use of information on them.

In a situation where the balance sheet is prepared for a quarter or other reporting period, in order for it to be considered at internal meetings for the purpose of introducing the state of affairs or analyzing the company’s activities, it is not necessary to fill in the code lines, since they do not carry any responsibility in this case no functions.

Line coding is performed only if this reporting documentation is submitted to government agencies and is not an obligation for the internal preparation of reporting balances. Since financial statements are submitted to the tax authorities only once a year, the coding applies only to annual balance sheets.

Comparison with old format codes

Previously, the line code consisted of three digits. At the moment, only those codes that are specified in a special appendix to Order 66 of the Ministry of Finance are being considered. This is app #4 which sets up four digit codes for use.

The encoding of the old form differs from the new one only in that the list of data lines changes, their encoding turns into a four-digit indicator, and the detail of the information provided in the balance sheet changes slightly. The row assignments remain the same.

Updated format strings and codes

It should be noted that the asset has a specialized format based on the liquidity factor of the property that the organization has. The least liquid of it will be located at the very top of the column, since it is this property that remains almost unchanged from the beginning of the organization until its liquidation.

The asset lines in the new balance sheet are: 1100, 1150-1260, 1600.

A liability tends to reflect where the company gets money for its operation. And also what part of these funds is the property of the company, and what part is borrowed and requires repayment. This part of the balance sheet plays an important role, since when compared with the asset, one can accurately say whether the company has the funds to successfully continue its activities, or whether the time will soon come to “wind up shop.”

The lines reflecting the passive part of the balance are: 1300, 1360-70, 1410-20, 1500-1550, 1700.

How to decrypt strings

In order to understand how the process of deciphering codes line by line is carried out, it is worth understanding that not a single code is a simple set of numbers. This is a code for a certain type of information.

- The first value confirms the fact that this line relates specifically to the main type of accounting statements, or rather, to the balance sheet, and not to another type of reporting documents.

- The second digit indicates which section of the asset the amount belongs to. For example, a unit indicates that the amount belongs to non-current assets.

- The third figure serves as a certain indicator of the liquidity of this resource.

- The fourth digit is initially equal to zero, adopted in order to provide some detailing of the items according to their materiality.

For example, deciphering line 1230 of the balance sheet is accounts receivable.

For a liability, decoding occurs according to the same principle as in the situation with an asset:

- The first digit indicates that it belongs specifically to the balance sheet for the year.

- The second figure demonstrates that this amount belongs to a separate section of the liability column.

- The third number indicates the urgency of the obligation.

- The fourth value is adopted for detailed perception of information.

The total liability is line 1700, which is the sum of line 1300 of the balance sheet, 1400 and 1500.

So, the process of deciphering the codes line by line in the balance sheet occurs on the basis of Appendix No. 4 to 66 Order of the Ministry of Finance. The structure of the codes themselves has a certain meaning. It is important to navigate in itself, or rather, in its sections and articles.

The general form of the balance sheet is given in Appendix No. 1 to Order No. 66n.

The balance sheet in its general form has columns in which the following indicators are given for each item:

As of December 31 of the previous year (when filling out the balance sheet for 2015 - as of December 31, 2014);

As of December 31 of the year preceding the previous one (when filling out the balance sheet for 2015 - as of December 31, 2013).

Column 1 of the balance sheet is intended to indicate the number of the corresponding explanation to the balance sheet (if an explanatory note is drawn up).

Organizations add column 3 independently to enter the line code in it.

The balance sheet contains two parts - assets and liabilities, which must be equal to each other.

The asset reflects the amount of non-current and current assets, and the liability - the amount of equity capital and borrowed funds, as well as accounts payable.

Section I. Non-current assets

Intangible assets. The residual value of intangible assets is reflected on line 1110. Clause 3 of PBU 14/2007 “Accounting for intangible assets”, approved by Order of the Ministry of Finance of Russia dated December 27, 2007 N 153n, allows you to find out what belongs to this group. Thus, in order to accept an object for accounting as an intangible asset, it is necessary that the following conditions be simultaneously met:

The object is capable of generating economic benefits in the future, and the organization has the right to receive them;

An object can be separated or separated (identified) from other assets;

The object is intended to be used for a long time, that is, it exceeds 12 months;

It is possible to reliably determine the actual (initial) cost of the object;

The object has no material form.

For example, if the specified conditions are met, intangible assets include works of science, literature and art, programs for electronic computers, inventions, utility models, selection achievements, production secrets (know-how), trademarks and service marks. Intangible assets also take into account business reputation arising in connection with the purchase of an enterprise as a property complex (in whole or part thereof).

Intangible assets do not include expenses associated with the formation of a legal entity (organizational expenses), intellectual and business qualities of the organization’s personnel, their qualifications and ability to work (clause 4 of PBU 14/2007).

Results of research and development. Research and development expenses recorded on account 04 “Intangible assets” are reflected on line 1120.

Intangible and tangible search assets. These two indicators are given in lines numbered 1130 and 1140. They are intended for organizations - users of subsoil to reflect information on the costs of developing natural resources (PBU 24/2011 “Accounting for the costs of developing natural resources”, approved by Order of the Ministry of Finance of Russia dated October 6, 2011 N 125n).

Fixed assets. For depreciable objects, the residual value of fixed assets is recorded in line 1150. If we are talking about non-depreciable property, then the line indicates its original cost.

Assets classified as fixed assets must comply with the conditions of clause 4 of PBU 6/01 “Accounting for fixed assets”, approved by Order of the Ministry of Finance of Russia dated March 30, 2001 N 26n.

Objects must be owned by the organization or have the right of operational management or economic management. It is also allowed to include property received under a leasing agreement as fixed assets if it is taken into account on the balance sheet of the lessee.

Objects subject to mandatory state registration of property rights are considered fixed assets from the moment they are registered, that is, like all other objects. The fact that documents are submitted to the appropriate authority does not matter.

In Sect. Form I of the balance sheet does not have the line “Construction in progress”. The question arises: under what balance sheet item should expenses for the construction of real estate objects be reflected? The answer is on line 1150 “Fixed assets”. This is stated in paragraph 20 of PBU 4/99, approved by Order of the Ministry of Finance of Russia dated July 6, 1999 N 43n. It’s best to add the decoding line “Construction in progress” to line 1150, using which to record the named expenses.

Profitable investments in material assets. Data on profitable investments in material assets corresponds to line indicator 1160. This is the residual value of property intended for rent (leasing) and accounted for in the account. If the property was first used for production and management needs, but was later leased out, it must be reflected in a separate subaccount of the account as part of fixed assets. This is due to the fact that the transfer of the value of fixed assets into profitable investments and back is not provided for in accounting (Letter of the Federal Tax Service of Russia dated May 19, 2005 N GV-6-21/418@).

Financial investments. For long-term financial investments, that is, with a circulation period of more than a year, line 1170 is allocated (for short-term ones - line 1240 of section II “Current assets”). Investments in subsidiaries, affiliates and other companies are also shown here. Financial investments are taken into account in the amount spent on their acquisition.

The cost of own shares purchased from shareholders for resale or cancellation, and interest-free loans issued to employees are not considered financial investments (clause 3 of PBU 19/02 “Accounting for financial investments”, approved by Order of the Ministry of Finance of Russia dated December 10, 2002 N 126n). For the first indicator, line 1320 is provided. The second indicator is reflected as part of accounts receivable, namely, long-term loans are shown on line 1190, short-term loans - on line 1230.

Deferred tax assets. Line 1180 “Deferred tax assets” is filled in by income tax payers. Since “simplified people” are not included in their number, it must be marked with a dash.

Other non-current assets. Here (line 1190) shows data on non-current assets that are not reflected in other lines of section. I balance sheet.

Section II. Current assets

Inventories. The cost of inventories is reflected on line 1210. Previously, this indicator had to be deciphered. In the current form, decryption is not required. However, it is needed if the indicators included in line 1210 are significant. In this case, you should add decryption lines, for example:

Raw materials and materials;

Costs in work in progress;

Finished products and goods for resale;

Goods shipped, etc.

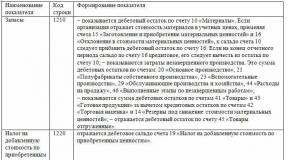

Value added tax on purchased assets.“Simplers” can fill out this line with code 1220 if, according to the organization’s accounting policy, the amounts of “input” VAT are reflected in account 19 “Value added tax on acquired assets.”

Accounts receivable. This line 1230 is intended for short-term receivables, that is, repayment of which is expected within 12 months after the reporting date.

Financial investments (excluding cash equivalents). For these assets, line 1240 is provided, which, in particular, shows loans provided by the organization for a period of less than 12 months.

If you are determining the current market value of financial investments, use all sources of information available to you, including data from foreign organized markets or trade organizers. Such recommendations are contained in the Letter of the Ministry of Finance of Russia dated January 29, 2009, 02/07/18/01. If at the reporting date you cannot determine the market value of a previously assessed object, reflect it at the cost of the last assessment.

Cash and cash equivalents. To fill out the line, you need to sum up the value of cash equivalents (the balance of the corresponding subaccounts of the account) and the balances of cash accounts (50 "Cash", 51 "Cash accounts", 52 "Currency accounts", 55 "Special accounts in banks" and 57 "Transfers to path").

The concept of cash equivalents, we recall, is contained in the Accounting Regulations “Cash Flow Statement” (PBU 23/2011), approved by Order of the Ministry of Finance of Russia dated 02.02.2011 N 11n. Cash equivalents may include, for example, demand deposits opened with credit institutions.

Other current assets. Here (line 1260) shows data on current assets that are not reflected in other lines of section. II balance.

Section III. Capital and reserves

Authorized capital (share capital, authorized capital, contributions of partners).

Line 1310 of the balance sheet reflects the amount of the company's authorized capital. It must coincide with the amount of the authorized capital, which is recorded in the constituent documents of the company.

Own shares purchased from shareholders. We have already said that if an organization purchased its own shares (shares of founders) in the authorized capital not for sale, then their value is entered in line 1320. Such shares are supposed to be canceled, which automatically leads to a decrease in the authorized capital, therefore the indicator in this line is given as a negative value in brackets. But if own shares are repurchased and resold, they are already considered an asset and their value must be entered in line 1260 “Other current assets.”

Revaluation of non-current assets. This line is assigned the number 1340 (there is no indicator for line number 1330). It shows the additional valuation of fixed assets and intangible assets, which is taken into account in account 83 “Additional capital”.

Additional capital (without revaluation). The amounts of additional capital are reflected on line 1350. Note that the indicator for this line is taken without taking into account the amounts of revaluation, which should be reflected in the line above.

Reserve capital. The balance of the reserve fund is indicated on line 1360. This reflects both reserves formed as required by law and reserves created in accordance with the constituent documents. Decoding is required only if the indicators are significant.

Retained earnings (uncovered loss). Retained earnings accumulated for all years, including the reporting one, are shown in line 1370. It also reflects the uncovered loss (only this amount is enclosed in brackets).

The components of the indicator (profit (loss) for the reporting year and (or) for previous periods) can be written down in additional lines, that is, a breakdown can be made based on the financial results obtained (profit/loss), as well as for all years of the company’s activity.

Section IV. Long-term liabilities

Borrowed funds. Line 1410 is reserved for the debt of the organization itself on long-term (with a repayment period of more than 12 months as of December 31, 2015) loans and credits.

Deferred tax liabilities. Line 1420 is filled in by income tax payers. “Simplers” are not included in their number, so they put a dash in this line.

Estimated liabilities. The specified line 1430 is filled in if the organization recognizes estimated liabilities in accounting in accordance with the Accounting Regulations “Estimated Liabilities, Contingent Liabilities and Contingent Assets” (PBU 8/2010), approved by Order of the Ministry of Finance of Russia dated December 13, 2010 N 167n. Let us remind you that small businesses, which are the majority of “simplified” ones, may not apply this PBU.

Other obligations. Here (line 1450) others are shown that are not reflected in other lines of section. IV balance. Please note that Order No. 66n does not provide an indicator for line 1440.

Section V. Current liabilities

Borrowed funds. Line 1510 indicates debt on short-term loans and borrowings taken out for a period of no more than 12 months. In this case, the amount should be reflected taking into account interest due at the end of the reporting period.

Accounts payable. The total amount of accounts payable is recorded in line 1520. And this should only be short-term debt.

Please note that there is no separate line for debt to participants (founders) for payment of income. The amount of such debt should be included here and deciphered on a separate line, since this indicator is always significant.

Future income. Line 1530 is filled in when the accounting provisions provide for the recognition of this accounting object. For example, if your organization receives budget funds or targeted funding. Such funds are precisely subject to accounting as part of deferred income in accounts 98 “Deferred Income” and 86 “Targeted Financing” (clauses 9 and 20 of the Accounting Regulations “Accounting for State Aid” (PBU 13/2000), approved Order of the Ministry of Finance of Russia dated October 16, 2000 N 92n).

Estimated liabilities. The explanations that we gave for line 1430 apply here: line 1540 is filled out if the company recognizes estimated liabilities in its accounting. Only line 1430 reflects long-term liabilities, and line 1540 - short-term liabilities.

Other obligations. Line 1550 shows others that are not reflected in other lines of section. V balance.

So, we have looked at the balance sheet items.

Now we offer a diagram that will help determine its indicators (we denote the debit and credit balances of the accounting accounts as Dt and Kt, respectively).

Section I "Non-current assets"

Line 1110 "Intangible assets"= Dt (without R&D expenses) - Kt.

Line 1120 "Results of research and development"= Dt (analytical account for accounting for R&D expenses).

Line 1130 "Intangible Exploration Assets"= Дт (analytical account of expenses for intangible search costs).

Line 1140 "Tangible Search Assets"= Dt (analytical account of expenses for material search costs).

Line 1150 "Fixed assets" = Dt - Kt + Dt (analytical account of expenses for construction in progress).

Line 1160 "Profitable investments in material assets"= Dt - Kt (analytical account for accounting for depreciation of property related to profitable investments).

Line 1170 "Financial investments"= Dt + Dt, sub-account "Deposit accounts", + Dt, sub-account "Settlements for loans provided" (analytical accounts for long-term financial investments), - Kt (analytical account for accounting for reserves for long-term financial investments).

Line 1180 "Deferred tax assets"= Dt.

Line 1190 "Other non-current assets"= value of non-current assets not taken into account in other indicators Sec. I balance sheet.

Line 1100 "Total for Section I"= sum of line indicators 1110 - 1190.

Section II "Current assets"

Line 1210 "Inventories"= sum of debit account balances , , , , , , , , , + Dt - Kt + Dt + Dt (or Dt - Kt) - Kt + Dt (analytical expense account with a write-off period of less than 12 months).

Line 1220 "VAT on purchased assets"= Dt.

Line 1230 "Accounts receivable"= Dt + Dt + Dt + Dt + Dt + Dt + Dt (except for interest-bearing loans) + Dt + Dt - Kt.

Line 1240 "Financial investments (except for cash equivalents)"= Dt + Dt, sub-account "Deposit accounts", + Dt, sub-account "Settlements for loans provided" (analytical accounts for short-term financial investments), - Kt (analytical account for accounting for reserves for short-term financial investments).

Line 1250 "Cash and cash equivalents"= Dt + Dt + + Dt + Dt + Dt - Dt, subaccount “Deposit accounts” (analytical accounts for accounting for financial investments).

Line 1260 "Other current assets"= value of current assets not included in other indicators in section. II balance sheet.

Line 1200 "Total for Section II"= sum of line indicators 1210 - 1260.

Line 1600 "Balance"= line indicator 1100 + line indicator 1200.

Section III "Capital and reserves"

Line 1310 "Authorized capital (share capital, authorized capital, contributions of partners)"= Kt.

Line 1320 "Own shares purchased from shareholders"= Dt. Enclose the indicator in parentheses.

Line 1340 "Revaluation of non-current assets"= Kt (analytical account for accounting for amounts of additional valuation of fixed assets and intangible assets).

Line 1350 "Additional capital (without revaluation)"= Kt (except for the amounts of additional valuation of fixed assets and intangible assets).

Line 1360 "Reserve capital"= Kt.

Line 1370 "Retained earnings (uncovered loss)"= Kt (Dt). If the debit balance is negative (that is, there is a loss), enclose it in brackets.

Line 1300 "Total for Section III"= sum of the indicators of lines 1310 - 1370. If the result is negative (if there are negative indicators for lines 1320 and 1370), show it in parentheses.

Section IV "Long-term liabilities"

Line 1410 "Borrowed funds"= Kt. In this case, accrued interest, the maturity of which as of the reporting date is less than 12 months, should be excluded and reflected on line 1510 (preferably with a breakdown).

Line 1420 "Deferred tax liabilities"= Kt.

Line 1430 "Estimated liabilities"= Kt (only estimated liabilities with a maturity period of more than 12 months after the reporting date).

Line 1450 "Other obligations"= long-term debt that is not included in other indicators in section. IV balance sheet.

Line 1400 "Total for Section IV"= the sum of the indicators of the above lines 1410 - 1450.

Section V "Short-term liabilities"

Line 1510 "Borrowed funds"= Kt + Kt (in terms of accrued interest, the repayment period of which as of the reporting date is not more than 12 months).

Line 1520 "Accounts payable"= Kt + Kt + Kt + Kt + Kt + Kt + Kt + Kt + Kt. In this case, take into account only short-term debt.

Line 1530 "Deferred income"= Kt + Kt in terms of targeted budget financing, grants, technical assistance, etc.

Line 1540 "Estimated liabilities"= Kt (only estimated liabilities with a maturity date of no more than 12 months after the reporting date).

Line 1550 "Other obligations"= amounts of debt on short-term obligations not taken into account when determining other indicators Sec. V balance.

Line 1500 "Total for Section V"= sum of line indicators 1510 - 1550.

Line 1700 "Balance"= row indicators 1300 + 1400 + 1500.

If all business transactions are reflected correctly and correctly transferred to the balance sheet, the indicators of lines 1600 and 1700 will coincide. If this equality is not observed, an error has been made somewhere. Then you need to check, recalculate and adjust the entered data.

Example. Filling out the balance sheet

The LLC, registered in 2015, applies a simplified taxation system. The indicators of the accounting registers as of December 31, 2015 are shown in the table:

Table

Balances (Kt - credit, Dt - debit) on accounts

accounting as of December 31, 2015

OOO

|

Balance |

Amount, rub. |

Balance |

Amount, rub. |

Individual organizations have the right to conduct accounting in a simplified form and create simplified financial statements. Such organizations include: small businesses, Skolkovo project organizations and non-profit organizations (except those recognized as foreign agents).

Simplified balance sheet

At the same time, small businesses can choose the form for preparing financial statements independently. They can provide reporting using both general and simplified forms. The composition of the reporting will depend on this. Thus, for small enterprises, special forms of simplified financial statements have been approved, given in Appendix 5 of Order No. 66n of the Ministry of Finance of Russia dated July 2, 2010. The composition of simplified financial statements is as follows:

- Balance Sheet;

- Financial results report.

If an enterprise needs to provide any additional information, and the simplified reporting forms do not contain the required columns, then general reporting forms can be used.

Thus, small businesses decide on their own which forms to submit financial statements. The main thing is that the decision made is reflected in the accounting policy.

Requirements for filling out a simplified balance sheet

The annual balance sheet must contain data on the assets and liabilities that the organization has at the end of the reporting year, that is, as of December 31. Additionally, information on previous years is entered into the balance sheet, that is, as of December 31 of last year and as of December 31 of the year before. For example, a balance sheet prepared by an enterprise for 2017 should contain data as of December 31, 2017, December 31, 2016 and December 31, 2015.

All last year's information is taken from last year's reports. And for indicators for the current year, information is taken from sources such as:

- The balance sheet for the organization as a whole for the reporting year;

- Indicators of accrued interest on credits (loans) for the reporting year.

If there is no data to fill out any balance line, it is not filled in and a dash is placed.

Procedure for filling out a simplified balance sheet

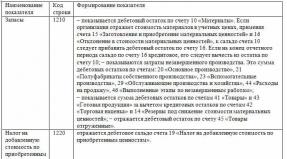

| Balance line | Accounting account |

| Assets | |

| 1150 “Tangible non-current assets” | Sum of indicators: · Account 01 “Fixed assets” minus account 02 “Depreciation of fixed assets” · Balance on account 07 “Equipment for installation” · Account balance 08 “Investments in non-current assets” |

| 1170 “Intangible, financial and other non-current assets” | Sum of indicators: · Account 04 “Intangible assets” minus account 05 “Amortization of intangible assets” · Balance on account 08 “Investments in non-current assets” (in relation to expenses for the development of mineral resources) · Account balance 09 “Deferred tax assets” · Account balance 58 “Financial investments” If there are no balances on these accounts, then a dash is placed |

| 1210 "Stocks" | Sum of indicators: · Account balance 10 “Materials” · Account balance 20 “Main production” · Account balance 41 “Goods” · Account balance 43 “Finished products” · Account balance 44 “Sales expenses” If other accounts are used in accounting, then Inventories are calculated according to the general rules for drawing up a balance sheet |

| 1250 “Cash and cash equivalents” | Account balance amount: · 50 "Cashier" · 51 “Current accounts” · 52 “Currency accounts” · 57 “Translations on the way” |

| 1230 “Financial and other current assets” | Amount of debit balance on accounts: · 70 “Settlements with personnel for wages” · 75 “Settlements with founders” Less the credit balance on account 63 “Provisions for doubtful debts” |

| 1600 Balance | Sum of indicators by row: 1150+1110+1210+1250+1240 |

| Passive | |

| 1300 "Capital and reserves" | 80 “Authorized capital” 82 “Reserve capital” 83 “Additional capital” 84 “Retained earnings” Less the amount of debit balance on accounts: 81 “Own shares (shares)” 84 “Retained earnings” |

| 1410 “Long-term borrowed funds” | Credit balance on account 67 “Settlements for long-term loans and borrowings” |

| 1450 “Other long-term liabilities” | This line is not filled in by small businesses, so a dash is placed |

| 1510 “Short-term borrowed funds” | Credit balance on account 66 “Settlements on short-term loans and borrowings” |

| 1520 “Accounts payable” | Amount of credit balance on accounts: · 60 “Settlements with suppliers and contractors” · 62 “Settlements with buyers and customers” · 76 “Settlements with various debtors and creditors” · 68 “Calculations for taxes and fees” · 69 “Calculations for social insurance and security” · 70 “Payroll calculations” · 71 “Settlements with accountable persons” · 73 “Settlements with personnel for other operations” · 75-2 “Calculations for payment of income” |

| 1550 “Other short-term liabilities” | Account balance amount: · 98 “Deferred income” · 96 “Reserves for future expenses” · 77 “Deferred tax liabilities” |

| 1700 Balance | Sum of indicators by row: 1310+1410+1450+1510+1520+1550 |

After filling out all balance sheet terms, you need to check whether the amount of assets and liabilities of the balance sheet is equal. If equality is observed, the balance sheet is considered to be drawn up correctly, and if the amounts do not agree, then errors were made in filling out the balance sheet.

The procedure for filling out a simplified statement of financial results

| Report Line | Accounting account |

| 2110 "Revenue" | Difference of indicators: · Turnover on the credit of the “Revenue” subaccount to the “Sales” account · Turnover by debit of the “VAT” subaccount to the “Sales” account |

| 2120 “Expenses for ordinary activities” | Amount by debit of subaccounts to account 90 “Sales”, on which accounting is kept: · Cost of sales · Business expenses · Administrative expenses |

| 2330 “Interest payable” | The amount of accrued interest on loans for the current year is indicated. The indicator is indicated in brackets, no minus sign is used. |

| 2340 “Other income” | Difference of indicators: · Turnover on the credit of the subaccount “Other income” to account 91 “Other income and expenses” · Turnover on the debit of the “VAT” subaccount to account 91 “Other income and expenses” |

| 2350 “Other expenses” | Difference of indicators: · Turnover on the debit of the subaccount “Other expenses” to account 91 “Other income and expenses” · Indicator for line 2330 “Interest payable” The indicator is indicated in brackets, no minus sign is used. |

| 2410 “Profit taxes (income)” | · If an organization pays income tax, then the value of line 180 of sheet 02 of the income tax declaration is recorded · If the organization is on the simplified tax system (income), then indicate the difference in indicators on lines 133 and 143 of section 2.1.1 of the declaration according to the simplified tax system · If the organization is on the simplified tax system (income minus expenses), then indicate the indicator on line 273 of section 2.2 of the declaration under the simplified tax system. When paying the minimum tax, the indicator is indicated on line 280 of section 2.2 of the declaration according to the simplified tax system. · If the organization is on UTII, then the amount of UTII for all quarters is indicated. The indicator is indicated in brackets, no minus sign is used. |

| 2400 “Net profit (loss)” | Calculate the value as follows: page 2110 – page 2120 – page 2330 + page 2340 – page 2350 – page 2410 |

If the resulting result of “Net profit (loss)” comes out with a minus sign, then it must be written down in the report, taken in brackets; the minus is not indicated. If the resulting value is positive, then there is no need to put it in brackets.

Code designations in the form of a balance sheet are necessary for statistical authorities to formulate final indicators for economic sectors in the context of individual indicators of the activities of business entities. The balance sheet with the entered codes is filled in at the end of the year. The ciphers are set in four-digit format.

Balance lines: asset

Order No. 66n, dated July 2, 2010, determines the division of the balance sheet into two sections - assets and liabilities. The asset shows the property of companies, expressed in tangible and intangible objects that have value for a particular enterprise. The asset consists of the following lines:

- To summarize information about non-current assets, line 1100 is used. Detailing is done line by line in columns with numbers from 1110 to 1190. Line 1150 of the balance sheet (decoding - fixed assets) is filled in if the company has fixed assets owned by it. Assets are accounted for at their residual value. Their total amount includes non-production and production facilities. An exception is made for property that was purchased for subsequent rental.

- Coding 1200 is intended for current assets. Line 1210 of the balance sheet (the transcript assigns it to inventories) combines the cost of goods, materials, finished goods and work in progress with the unwritten off balances of household inventory and office supplies. What does line 1210 of the balance sheet consist of - it includes the sum of balances formed on accounts 10, 11, 15, 20, 21, 23, 28, 29, 46, 45, 44, 43, 41. Information on inventories in auxiliary and servicing structural divisions are entered in 1210 (balance sheet line to reflect the accumulated value of inventories) from accounts 23 and 29. Enterprises that have animals for farming, information is taken from the debit balance of account 11. If there is a reserve for the depreciation of inventories, the value of the account balance is subtracted from the amount of debit balances 14 (credit).

- Line 1250 of the balance sheet - decoding implies combining the values for all bank accounts (at the cash desk, on bank accounts, in transit).

The results for the active part of the balance are summarized in line 1600.

Balance sheet lines 2017: decoding of liability items

The passive part of the report contains three groups of item-by-item decoding of accounting data based on the results of work for the last year. The first block of information shows the value of capital in its various forms (lines 1310-1360). Capital takes into account profits or losses that were not distributed on the last day of the reporting period - line 1370 of the balance sheet.

These indicators are presented in more detail in the statement of changes in equity. Profit amounts are reflected in an additional form - a statement of financial results. Line 1370 of the balance sheet - the decoding focuses on the value of profit in monetary terms, which is subject to distribution. Its payment can be initiated in the new year by the decision of the founders.

What does line 1370 of the balance sheet consist of:

- account balance 84;

- the value of the balance formed on account 99 (if an intermediate reporting type is generated).

The next block of information concerns the long-term type of liabilities of the company. It consists of lines 1410-1450. The data must correspond to the information given in Form 5. Short-term loans and borrowings in the balance sheet - line 1500. Liabilities are detailed by the following groups:

- in the column with code 1510, the credit balance of account 66 is indicated;

- line 1520 of the balance sheet - decoding involves displaying the sum of values from the balances of accounts 69, 68, 62, 60, 76, 75, 73, 71, 70;

- in the cell next to code 1550 they show those amounts of the company’s short-term liabilities that, for objective reasons, were not included in other lines for recording borrowed resources with a maturity of less than a year.

When line 1520 of the balance sheet is filled out, the entered data must be checked against the information detailed in Form 5. The column is intended for entering information about the current state of settlements with counterparties and accountable persons, employees of the company in the context of debts to them under existing contractual relationships. The results of the liability are summarized in line 1700. The performance indicators of the asset and liability in the report must be equal. If they do not agree, then the balance sheet is drawn up incorrectly.

This line reflects the amount of the authorized capital (share capital, authorized capital) of the organization. When drawing up a separate balance sheet for joint activities, the participant conducting common affairs indicates in the line under consideration the amount of contributions made by the partners.

Before registering changes in the constituent documents, funds and other property received from shareholders (participants) in connection with an increase in the size of the company’s authorized capital, the Russian Ministry of Finance recommends that they be reflected in the Balance Sheet separately under a separate item in section. III “Capital and reserves” (Appendix to the Letter of the Ministry of Finance of Russia dated 02/06/2015 N 07-04-06/5027). To implement this recommendation, it is necessary to provide in Sec. III separate line. In this case, the value of the property received should not participate in the formation of the line 1310 indicator.

How much is reflected in accounting?authorized capital (share capital, authorized capital,contributions of comrades)?

In accounting, account 80 “Authorized capital” reflects the amount of authorized (share) capital registered in the constituent documents and representing the totality of contributions (shares, shares) of the founders (participants) of the organization. The balance of account 80 corresponds to the amount of the authorized capital (share capital, authorized fund) recorded in the constituent documents of the organization, and does not depend on whether the participants have fully made their contributions on the reporting date or not.

State and municipal unitary enterprises on account 80 take into account the amount of the authorized capital formed in the prescribed manner (paragraph 1, 3, clause 67 of the Regulations on Accounting and Financial Reporting, Instructions for the Application of the Chart of Accounts).

In a separate balance sheet for joint activities, contributions of partners are reflected in account 80 “Deposits of partners” in the amount of deposits actually made by participants (Instructions for using the Chart of Accounts).

What accounting data is used?when filling out line 1310 “Authorized capital

When filling out this line of the Balance Sheet, data on the credit balance of account 80 as of the reporting date is used.

The authorized (share) capital in full, as well as the actual debt of the founders (participants) for contributions (contributions) to the authorized (share) capital are reflected in the Balance Sheet separately (paragraph 2 of clause 67 of the Regulations on Accounting and Financial Reporting, Instructions on the application of the Chart of Accounts). The debt of the founders is shown in line 1230 “Accounts receivable”.

Note that if an organization decides to increase (decrease) its authorized capital, then the new amount of authorized capital is shown in the Balance Sheet only after registration of changes in the organization’s constituent documents. Even if an organization bought back shares (shares) in order to reduce the authorized capital, then before the state registration of the decrease in the authorized capital, the full amount of the authorized capital is reflected in line 1310 “Authorized capital (joint capital, authorized capital, contributions of partners)”, and the cost of the repurchased shares (shares) ) is shown in parentheses on line 1320 “Own shares purchased from shareholders.”

Line 1310 “Authorized capital” = Account credit balance 80

The indicators in line 1310 “Authorized capital (share capital, authorized capital, contributions of partners)” as of December 31 of the previous year and as of December 31 of the year preceding the previous year are transferred from the Balance Sheet for the previous year.

Example of filling out line 1310 “Authorized capital(share capital, authorized capital, contributions of partners)"

Account indicator 80: rub.

Fragment of the Balance Sheet for 2013

Solution

The amount of authorized capital is:

A fragment of the Balance Sheet in Example 3.1 will look like this.

| Explanations | Indicator name | Code | As of December 31, 2014 | As of December 31, 2013 | As of December 31, 2012 |

| 1 | 2 | 3 | 4 | 5 | 6 |

| III. CAPITAL AND RESERVES | |||||

| Authorized capital (share capital, authorized capital, contributions of partners) | 1310 | 1000 | 1000 |